[PRESS RELEASE] – CHICAGO, Aug. 7, 2025 – Verano Holdings Corp., a number one multistate hashish corporate, introduced its monetary effects for the second one quarter ended June 30, 2025, which have been ready in keeping with U.S. most often authorized accounting ideas (GAAP).

2d Quarter 2025 Monetary Highlights

2d Quarter 2025 Monetary Highlights

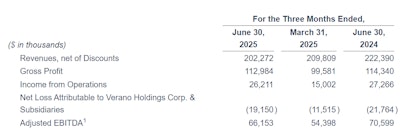

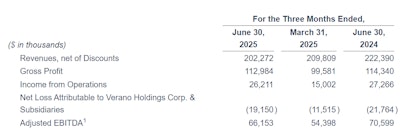

- Revenues, web of reductions, of $202 million.

- Gross benefit of $113 million or 56% of income.

- SG&A bills of $86 million or 43% of income.

- Internet Lack of $(19) million or (9)% of income.

- Adjusted EBITDA1 of $66 million or 33% of income.

- Internet money supplied via working actions of $11 million.

- Capital expenditures of $10 million.

Control Observation

“I’m pleased with the development we made right through the quarter to support our basis and advance key priorities, together with streamlining our operations and making improvements to margins,” Verano Chairman and CEO George Archos stated. “During the quarter, we generated extra environment friendly and productive cultivation yields, delivered new product innovation and stepped forward retail efficiency in numerous key markets.”

Archos stated, “As we focal point on making improvements to our wholesale industry and accounts receivable technique, given our pipeline of recent retailer openings and product innovation, and our ongoing potency efforts, we look ahead to a more potent 2d part of 2025 for Verano and look ahead to advancing key projects all over the rest of the yr.”

2d Quarter 2025 Monetary Assessment

Revenues, web of reductions, for the second one quarter 2025 have been $202 million, down from $222 million for the second one quarter of 2024, and down from $210 million for the primary quarter of 2025.

The lower in income for the second one quarter 2025 in comparison to the second one quarter 2024 was once pushed basically via ongoing value compression, pageant and affects from the corporate’s wholesale accounts receivable technique, which was once in part offset via sure leads to Ohio, robust gross sales in Florida and contributions from operations got from The Cannabist Co. Holdings Inc. within the 3rd quarter of 2024.

Gross benefit for the second one quarter 2025 was once $113 million or 56% of income, down from $114 million or 51% of income for the second one quarter 2024, and up from $100 million or 47% of income for the primary quarter 2025. The lower in gross benefit for the second one quarter 2025 in comparison to the second one quarter 2024 was once because of total top-line income declines and greater promotional task, in part offset via extra environment friendly harvests from expanded cultivation amenities.

SG&A bills for the second one quarter 2025 have been $86 million or 43% of income, down from $87 million or 39% of income for the second one quarter 2024, and up from $85 million or 40% of income for the primary quarter 2025. The lower in SG&A bills for the second one quarter 2025 in comparison to the second one quarter 2024 was once pushed basically via a lower in depreciation and amortization and ongoing efficiencies generated around the industry.

Internet loss for the second one quarter 2025 was once $(19) million or (9)% of income, as opposed to $(22) million or (10)% of income in the second one quarter 2024. The lower in web loss for the second one quarter 2025 in comparison to the second one quarter 2024 was once basically pushed via an total lower in different source of revenue (expense), in part offset via an build up within the provision for source of revenue taxes in comparison to the prior yr duration.

Adjusted EBITDA1 for the second one quarter 2025 was once $66 million or 33% of income.

Internet money supplied via working actions for the second one quarter 2025 was once $11 million, up from $8 million for the second one quarter 2024, which was once basically because of operational efficiencies and a lower in source of revenue tax bills made in comparison to the prior yr duration.

Capital expenditures for the second one quarter 2025 have been $10 million, down from $19 million for the second one quarter 2024 and down from $14 million within the first quarter 2025. The lower in capital expenditures was once pushed via reaching better efficiencies around the corporate’s cultivation and manufacturing amenities.

2d Quarter 2025 Operational Highlights

- Promoted and appointed Richard Tarapchak as leader monetary officer.

- Expanded the corporate’s retail footprint via opening the next new dispensaries:

- MÜV™ New Smyrna Seaside, the corporate’s 81st dispensary in Florida; and

- Zen Leaf™ Ashford and Zen Leaf™ Enfield, raising the corporate’s Connecticut retail operations to seven dispensaries statewide.

- Introduced an unique partnership with Develop Sciences, an award-winning cultivator of elite genetics in craft hashish codecs, to release its suite of flower and extract merchandise within the Illinois marketplace.

- Offered an cutting edge bodega-style retail enjoy at Zen Leaf Cave Creek in Phoenix, that includes one of the vital greatest assortments of at once out there hashish merchandise within the U.S.

Next Operational Highlights

- Promoted and appointed James Leventis as leader technique and compliance officer in July.

- Present operations span 13 states, made out of 157 dispensaries and 15 manufacturing amenities with greater than 1.1 million sq. ft of cultivation capability.

Steadiness Sheet and Liquidity

As of June 30, 2025, the corporate’s present belongings have been $371 million, together with money and money equivalents of $69 million. The corporate had operating capital of $224 million and general debt, web of issuance prices, of $403 million.

The corporate’s general Magnificence A subordinate vote casting stocks exceptional have been 361,779,913 as of June 30, 2025.

A line-by-line breakdown of the corporate’s steadiness sheet and definitions for this press unlock are to be had right here.

[PRESS RELEASE] – CHICAGO, Aug. 7, 2025 – Verano Holdings Corp., a number one multistate hashish corporate, introduced its monetary effects for the second one quarter ended June 30, 2025, which have been ready in keeping with U.S. most often authorized accounting ideas (GAAP).

2d Quarter 2025 Monetary Highlights

2d Quarter 2025 Monetary Highlights

- Revenues, web of reductions, of $202 million.

- Gross benefit of $113 million or 56% of income.

- SG&A bills of $86 million or 43% of income.

- Internet Lack of $(19) million or (9)% of income.

- Adjusted EBITDA1 of $66 million or 33% of income.

- Internet money supplied via working actions of $11 million.

- Capital expenditures of $10 million.

Control Observation

“I’m pleased with the development we made right through the quarter to support our basis and advance key priorities, together with streamlining our operations and making improvements to margins,” Verano Chairman and CEO George Archos stated. “During the quarter, we generated extra environment friendly and productive cultivation yields, delivered new product innovation and stepped forward retail efficiency in numerous key markets.”

Archos stated, “As we focal point on making improvements to our wholesale industry and accounts receivable technique, given our pipeline of recent retailer openings and product innovation, and our ongoing potency efforts, we look ahead to a more potent 2d part of 2025 for Verano and look ahead to advancing key projects all over the rest of the yr.”

2d Quarter 2025 Monetary Assessment

Revenues, web of reductions, for the second one quarter 2025 have been $202 million, down from $222 million for the second one quarter of 2024, and down from $210 million for the primary quarter of 2025.

The lower in income for the second one quarter 2025 in comparison to the second one quarter 2024 was once pushed basically via ongoing value compression, pageant and affects from the corporate’s wholesale accounts receivable technique, which was once in part offset via sure leads to Ohio, robust gross sales in Florida and contributions from operations got from The Cannabist Co. Holdings Inc. within the 3rd quarter of 2024.

Gross benefit for the second one quarter 2025 was once $113 million or 56% of income, down from $114 million or 51% of income for the second one quarter 2024, and up from $100 million or 47% of income for the primary quarter 2025. The lower in gross benefit for the second one quarter 2025 in comparison to the second one quarter 2024 was once because of total top-line income declines and greater promotional task, in part offset via extra environment friendly harvests from expanded cultivation amenities.

SG&A bills for the second one quarter 2025 have been $86 million or 43% of income, down from $87 million or 39% of income for the second one quarter 2024, and up from $85 million or 40% of income for the primary quarter 2025. The lower in SG&A bills for the second one quarter 2025 in comparison to the second one quarter 2024 was once pushed basically via a lower in depreciation and amortization and ongoing efficiencies generated around the industry.

Internet loss for the second one quarter 2025 was once $(19) million or (9)% of income, as opposed to $(22) million or (10)% of income in the second one quarter 2024. The lower in web loss for the second one quarter 2025 in comparison to the second one quarter 2024 was once basically pushed via an total lower in different source of revenue (expense), in part offset via an build up within the provision for source of revenue taxes in comparison to the prior yr duration.

Adjusted EBITDA1 for the second one quarter 2025 was once $66 million or 33% of income.

Internet money supplied via working actions for the second one quarter 2025 was once $11 million, up from $8 million for the second one quarter 2024, which was once basically because of operational efficiencies and a lower in source of revenue tax bills made in comparison to the prior yr duration.

Capital expenditures for the second one quarter 2025 have been $10 million, down from $19 million for the second one quarter 2024 and down from $14 million within the first quarter 2025. The lower in capital expenditures was once pushed via reaching better efficiencies around the corporate’s cultivation and manufacturing amenities.

2d Quarter 2025 Operational Highlights

- Promoted and appointed Richard Tarapchak as leader monetary officer.

- Expanded the corporate’s retail footprint via opening the next new dispensaries:

- MÜV™ New Smyrna Seaside, the corporate’s 81st dispensary in Florida; and

- Zen Leaf™ Ashford and Zen Leaf™ Enfield, raising the corporate’s Connecticut retail operations to seven dispensaries statewide.

- Introduced an unique partnership with Develop Sciences, an award-winning cultivator of elite genetics in craft hashish codecs, to release its suite of flower and extract merchandise within the Illinois marketplace.

- Offered an cutting edge bodega-style retail enjoy at Zen Leaf Cave Creek in Phoenix, that includes one of the vital greatest assortments of at once out there hashish merchandise within the U.S.

Next Operational Highlights

- Promoted and appointed James Leventis as leader technique and compliance officer in July.

- Present operations span 13 states, made out of 157 dispensaries and 15 manufacturing amenities with greater than 1.1 million sq. ft of cultivation capability.

Steadiness Sheet and Liquidity

As of June 30, 2025, the corporate’s present belongings have been $371 million, together with money and money equivalents of $69 million. The corporate had operating capital of $224 million and general debt, web of issuance prices, of $403 million.

The corporate’s general Magnificence A subordinate vote casting stocks exceptional have been 361,779,913 as of June 30, 2025.

A line-by-line breakdown of the corporate’s steadiness sheet and definitions for this press unlock are to be had right here.