[PRESS RELEASE] – CHELMSFORD, Mass., Might 8, 2025 – The Cannabist Co. Holdings Inc., some of the skilled cultivators, producers and outlets of hashish merchandise within the U.S., reported its monetary and working effects for the primary quarter ended March 31, 2025. All monetary knowledge offered on this unlock is in U.S. usually authorized accounting ideas (GAAP), unaudited, and in 1000’s of U.S. bucks, except in a different way famous.

Control Observation

“In the course of the first quarter of 2025, now we have persevered to make development on our plans to simplify and optimize the industry, which drove a sequential growth in margins,” The Cannabist Co. CEO David Hart stated. “We’re decreasing working and overhead prices and feature complex ongoing tasks to strengthen working efficiency, as we rationalize SKUs and toughen our pricing structure throughout lively markets. To that finish, we noticed an growth in retail gross margin and luck from area manufacturers, corresponding to dreamt. As we persevered to refine the footprint all through the quarter, we finished the go out of the Washington, D.C., marketplace, bought one dispensary in California, and closed 3 underperforming places in Colorado. We stay interested in finishing ultimate divestitures in Florida, California and Illinois, which can lend a hand to additional simplify the industry and supply liquidity.

“With recognize to our pending debt restructuring transaction, on April 29, holders of our senior notes voted to approve the proposed association solution. The important ultimate step as a way to advance the transaction is to acquire court docket popularity of the transaction in Canada. Courtroom lawsuits are scheduled for later this month to believe our approval request and debtholder objections.

“As now we have mentioned up to now, our priorities during 2025 will proceed to be liquidity and stability sheet control along operational enhancements to simplify, cut back prices, and optimize the industry. We look ahead to opening further retail places in Ohio and Virginia this 12 months and are ready for the transition to grownup use in Delaware.”

Best 5 Markets by means of Income in Q1[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

Best 5 Markets by means of Adjusted EBITDA in Q1[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

| [3] | Markets are indexed alphabetically |

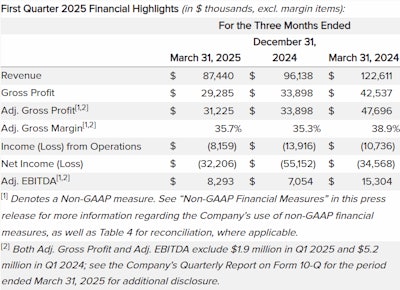

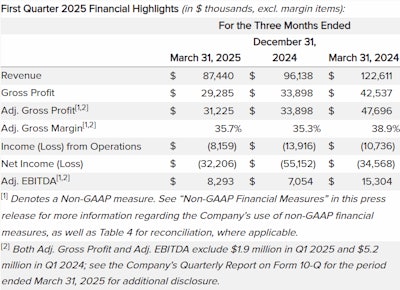

Monetary Highlights for First Quarter 2025

- First quarter earnings of $87 million, a lower of 9% in comparison to This autumn, partly because of the closure of 3 places in Colorado and the sale of 1 location in California.

- Adjusted gross margin within the first quarter was once 36%, up 45 foundation issues sequentially in comparison to This autumn.

- Adjusted EBITDA in Q1 of $7.1 million; adjusted EBITDA margin greater greater than 200 foundation issues sequentially to 9.5%.

- For the 11 markets ultimate following divestiture of Florida and Washington, D.C., Adjusted EBITDA margin was once 9.8% in Q1.

- Capital expenditures within the first quarter have been $2 million; the corporate continues to be expecting capital expenditures to reasonable $2 million to $3 million in step with quarter in 2025, basically for brand new retailer openings.

- The corporate ended the primary quarter with $18.9 million in money, as in comparison with $33.6 million on the finish of This autumn.

- Next to quarter shut, on April 17, the corporate closed at the sale of its ultimate MMTC license in Florida for gross proceeds of $5 million; the sale of 1 cultivation facility in Florida is pending finalization.

- Next to quarter shut, on April 29, holders of senior notes voted to approve the up to now introduced association to increase the maturities of senior secured notes to December 2028, with choices to increase via 2029. The important ultimate step as a way to advance the transaction is to acquire court docket popularity of the transaction in Canada. Courtroom lawsuits are scheduled for later this month to believe the corporate’s approval request and debtholder objections.

- Next to quarter shut, corporate affected a company restructuring for an estimated $3.8 million in annualized price financial savings because of changes to align with a simplified footprint; that is along with a number of rounds of company restructuring all through 2024, the place the corporate completed $23 million in annualized price financial savings.

Operational Highlights for First Quarter 2025

- For Q1 2025, wholesale earnings greater 3.5% sequentially to $16 million; wholesale accounted for about 18% of overall earnings, in comparison to 16% in This autumn.

- Retail gross margin greater 180 foundation issues over This autumn, as efforts proceed to rationalize SKUs and strengthen pricing structure throughout our markets.

- All through Q1, introduced the dreamt emblem in Massachusetts, New Jersey and Virginia—including to the preliminary luck of dreamt in Maryland, the place the product was once the highest promoting sleep SKU throughout the corporate’s Maryland retail outlets.

- On account of the sale of 1 dispensary in California, and closure of 3 underperforming places in Colorado, the quarter-end lively retail depend was once 55, in comparison to 59 on the finish of This autumn.

- Next to quarter shut, in April, the corporate signed control products and services agreements for 2 retail places in California which are pending ultimate sale, bringing the lively retail depend to 53.

- Next to quarter shut, the corporate introduced adult-use gross sales on the 3rd retail location in New Jersey, Cannabist Mays Touchdown, which opened on Dec. 31, 2024.

- The corporate has further retail places in building, together with one in Virginia and 3 in Ohio, with one Ohio location anticipated to open in Q3.

Non-GAAP Monetary Measures

On this press unlock, the corporate refers to positive non-GAAP monetary measures, together with Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Benefit and Adjusted Gross Margin. The corporate considers positive non-GAAP measures to be significant signs of the efficiency of its industry. Those measures don’t seem to be identified measures below GAAP, do not need a standardized which means prescribed by means of GAAP and is probably not related to (and could also be calculated otherwise by means of) different firms that provide an identical measures. Accordingly, those measures will have to no longer be thought to be in isolation from nor as an alternative choice to our monetary knowledge reported below GAAP. Those non-GAAP measures are used to supply traders with supplemental measures of our working efficiency and thus spotlight developments in our industry that won’t in a different way be obvious when depending only on GAAP measures. Those supplemental non-GAAP monetary measures will have to no longer be thought to be awesome to, as an alternative choice to, or as an alternative choice to, and will have to be thought to be at the side of, the GAAP monetary measures offered. We additionally acknowledge that securities analysts, traders and different events often use non-GAAP measures within the analysis of businesses inside our business.

With recognize to non-GAAP monetary measures, the corporate defines EBITDA as internet source of revenue (loss) prior to (i) depreciation and amortization; (ii) source of revenue taxes; and (iii) hobby expense and debt amortization. Adjusted EBITDA is outlined as EBITDA prior to (i) share-based repayment expense; (ii) goodwill and intangible impairment, (iii) changes for acquisition and different non-core prices; (iv) achieve on remeasurement of contingent attention, internet, (v) truthful price adjustments on by-product liabilities; and (vi) truthful price mark-up for bought stock. Adjusted EBITDA Margin is outlined as Adjusted EBITDA divided by means of Income. Adjusted Gross Benefit is outlined as gross benefit prior to the truthful mark-up for bought stock. Adjusted Gross Margin is outlined as gross margin prior to the truthful mark-up for bought stock.

The corporate perspectives those non-GAAP monetary measures as a way to facilitate control’s monetary and operational decision-making, together with analysis of the corporate’s ancient working effects and comparability to competition’ working effects. Those non-GAAP monetary measures mirror an extra method of viewing facets of the corporate’s operations that, when considered with GAAP effects and the reconciliations to the corresponding GAAP monetary measure, would possibly supply a extra whole figuring out of things and developments affecting the corporate’s industry. The resolution of the quantities which are excluded from those non-GAAP monetary measures are a question of control judgment and depend on, amongst different elements, the character of the underlying expense or source of revenue quantities. As a result of non-GAAP monetary measures exclude the impact of things that may building up or lower the corporate’s reported result of operations, control strongly encourages traders to study the corporate’s consolidated monetary statements and publicly filed stories of their entirety.

Reconciliations of non-GAAP monetary measures to their nearest related GAAP measures are incorporated on this press unlock and an additional dialogue of a few of these pieces is contained in our annual record on Shape 10-Ok.

[PRESS RELEASE] – CHELMSFORD, Mass., Might 8, 2025 – The Cannabist Co. Holdings Inc., some of the skilled cultivators, producers and outlets of hashish merchandise within the U.S., reported its monetary and working effects for the primary quarter ended March 31, 2025. All monetary knowledge offered on this unlock is in U.S. usually authorized accounting ideas (GAAP), unaudited, and in 1000’s of U.S. bucks, except in a different way famous.

Control Observation

“In the course of the first quarter of 2025, now we have persevered to make development on our plans to simplify and optimize the industry, which drove a sequential growth in margins,” The Cannabist Co. CEO David Hart stated. “We’re decreasing working and overhead prices and feature complex ongoing tasks to strengthen working efficiency, as we rationalize SKUs and toughen our pricing structure throughout lively markets. To that finish, we noticed an growth in retail gross margin and luck from area manufacturers, corresponding to dreamt. As we persevered to refine the footprint all through the quarter, we finished the go out of the Washington, D.C., marketplace, bought one dispensary in California, and closed 3 underperforming places in Colorado. We stay interested in finishing ultimate divestitures in Florida, California and Illinois, which can lend a hand to additional simplify the industry and supply liquidity.

“With recognize to our pending debt restructuring transaction, on April 29, holders of our senior notes voted to approve the proposed association solution. The important ultimate step as a way to advance the transaction is to acquire court docket popularity of the transaction in Canada. Courtroom lawsuits are scheduled for later this month to believe our approval request and debtholder objections.

“As now we have mentioned up to now, our priorities during 2025 will proceed to be liquidity and stability sheet control along operational enhancements to simplify, cut back prices, and optimize the industry. We look ahead to opening further retail places in Ohio and Virginia this 12 months and are ready for the transition to grownup use in Delaware.”

Best 5 Markets by means of Income in Q1[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

Best 5 Markets by means of Adjusted EBITDA in Q1[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

| [3] | Markets are indexed alphabetically |

Monetary Highlights for First Quarter 2025

- First quarter earnings of $87 million, a lower of 9% in comparison to This autumn, partly because of the closure of 3 places in Colorado and the sale of 1 location in California.

- Adjusted gross margin within the first quarter was once 36%, up 45 foundation issues sequentially in comparison to This autumn.

- Adjusted EBITDA in Q1 of $7.1 million; adjusted EBITDA margin greater greater than 200 foundation issues sequentially to 9.5%.

- For the 11 markets ultimate following divestiture of Florida and Washington, D.C., Adjusted EBITDA margin was once 9.8% in Q1.

- Capital expenditures within the first quarter have been $2 million; the corporate continues to be expecting capital expenditures to reasonable $2 million to $3 million in step with quarter in 2025, basically for brand new retailer openings.

- The corporate ended the primary quarter with $18.9 million in money, as in comparison with $33.6 million on the finish of This autumn.

- Next to quarter shut, on April 17, the corporate closed at the sale of its ultimate MMTC license in Florida for gross proceeds of $5 million; the sale of 1 cultivation facility in Florida is pending finalization.

- Next to quarter shut, on April 29, holders of senior notes voted to approve the up to now introduced association to increase the maturities of senior secured notes to December 2028, with choices to increase via 2029. The important ultimate step as a way to advance the transaction is to acquire court docket popularity of the transaction in Canada. Courtroom lawsuits are scheduled for later this month to believe the corporate’s approval request and debtholder objections.

- Next to quarter shut, corporate affected a company restructuring for an estimated $3.8 million in annualized price financial savings because of changes to align with a simplified footprint; that is along with a number of rounds of company restructuring all through 2024, the place the corporate completed $23 million in annualized price financial savings.

Operational Highlights for First Quarter 2025

- For Q1 2025, wholesale earnings greater 3.5% sequentially to $16 million; wholesale accounted for about 18% of overall earnings, in comparison to 16% in This autumn.

- Retail gross margin greater 180 foundation issues over This autumn, as efforts proceed to rationalize SKUs and strengthen pricing structure throughout our markets.

- All through Q1, introduced the dreamt emblem in Massachusetts, New Jersey and Virginia—including to the preliminary luck of dreamt in Maryland, the place the product was once the highest promoting sleep SKU throughout the corporate’s Maryland retail outlets.

- On account of the sale of 1 dispensary in California, and closure of 3 underperforming places in Colorado, the quarter-end lively retail depend was once 55, in comparison to 59 on the finish of This autumn.

- Next to quarter shut, in April, the corporate signed control products and services agreements for 2 retail places in California which are pending ultimate sale, bringing the lively retail depend to 53.

- Next to quarter shut, the corporate introduced adult-use gross sales on the 3rd retail location in New Jersey, Cannabist Mays Touchdown, which opened on Dec. 31, 2024.

- The corporate has further retail places in building, together with one in Virginia and 3 in Ohio, with one Ohio location anticipated to open in Q3.

Non-GAAP Monetary Measures

On this press unlock, the corporate refers to positive non-GAAP monetary measures, together with Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Benefit and Adjusted Gross Margin. The corporate considers positive non-GAAP measures to be significant signs of the efficiency of its industry. Those measures don’t seem to be identified measures below GAAP, do not need a standardized which means prescribed by means of GAAP and is probably not related to (and could also be calculated otherwise by means of) different firms that provide an identical measures. Accordingly, those measures will have to no longer be thought to be in isolation from nor as an alternative choice to our monetary knowledge reported below GAAP. Those non-GAAP measures are used to supply traders with supplemental measures of our working efficiency and thus spotlight developments in our industry that won’t in a different way be obvious when depending only on GAAP measures. Those supplemental non-GAAP monetary measures will have to no longer be thought to be awesome to, as an alternative choice to, or as an alternative choice to, and will have to be thought to be at the side of, the GAAP monetary measures offered. We additionally acknowledge that securities analysts, traders and different events often use non-GAAP measures within the analysis of businesses inside our business.

With recognize to non-GAAP monetary measures, the corporate defines EBITDA as internet source of revenue (loss) prior to (i) depreciation and amortization; (ii) source of revenue taxes; and (iii) hobby expense and debt amortization. Adjusted EBITDA is outlined as EBITDA prior to (i) share-based repayment expense; (ii) goodwill and intangible impairment, (iii) changes for acquisition and different non-core prices; (iv) achieve on remeasurement of contingent attention, internet, (v) truthful price adjustments on by-product liabilities; and (vi) truthful price mark-up for bought stock. Adjusted EBITDA Margin is outlined as Adjusted EBITDA divided by means of Income. Adjusted Gross Benefit is outlined as gross benefit prior to the truthful mark-up for bought stock. Adjusted Gross Margin is outlined as gross margin prior to the truthful mark-up for bought stock.

The corporate perspectives those non-GAAP monetary measures as a way to facilitate control’s monetary and operational decision-making, together with analysis of the corporate’s ancient working effects and comparability to competition’ working effects. Those non-GAAP monetary measures mirror an extra method of viewing facets of the corporate’s operations that, when considered with GAAP effects and the reconciliations to the corresponding GAAP monetary measure, would possibly supply a extra whole figuring out of things and developments affecting the corporate’s industry. The resolution of the quantities which are excluded from those non-GAAP monetary measures are a question of control judgment and depend on, amongst different elements, the character of the underlying expense or source of revenue quantities. As a result of non-GAAP monetary measures exclude the impact of things that may building up or lower the corporate’s reported result of operations, control strongly encourages traders to study the corporate’s consolidated monetary statements and publicly filed stories of their entirety.

Reconciliations of non-GAAP monetary measures to their nearest related GAAP measures are incorporated on this press unlock and an additional dialogue of a few of these pieces is contained in our annual record on Shape 10-Ok.