[PRESS RELEASE] – TORONTO, March 6, 2025 – TerrAscend Corp., a number one North American hashish corporation, reported its monetary effects for the fourth quarter and entire 12 months ended Dec. 31, 2024. All quantities are expressed in U.S. bucks and are ready underneath U.S. most often accredited accounting rules (GAAP), until indicated differently.

The following monetary measures with recognize to the entire 12 months 2024 are reported as effects from proceeding operations because of the shutdown of the authorized manufacturer industry in Canada, which is reported as discontinued operations via Sept. 30, 2023. All ancient classes were restated accordingly.

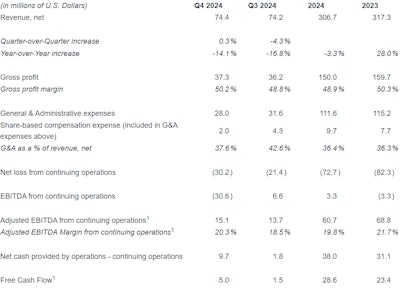

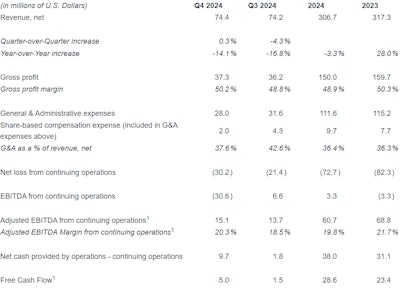

Fourth Quarter 2024 Monetary Highlights

- Web Income was once $74.4 million, in comparison to $74.2 million in Q3 2024, an build up of 0.3% quarter-over-quarter.

- Gross Benefit Margin was once 50.2%, up 140 foundation issues in comparison to 48.8% in Q3 2024.

- GAAP Web loss was once $30.2 million, in comparison to a internet lack of $21.4 million in Q3 2024; This fall 2024 internet loss incorporated a $45.4 million non-cash impairment price associated with the corporate’s Michigan industry.

- EBITDA1 loss was once $30.6 million, in comparison to $6.6 million in Q3 2024; This fall 2024 loss incorporated a $45.4 million non-cash impairment price basically associated with the corporate’s Michigan industry.

- Adjusted EBITDA1 was once $15.1 million, in comparison to $13.7 million in Q3 2024.

- Adjusted EBITDA Margin1 was once 20.3%, in comparison to 18.5% in Q3 2024.

- Web Money equipped by way of running actions was once $9.7 million, in comparison to $1.8 million in Q3 2024.

- Loose Money Drift1 was once $5 million, when compared to $1.5 million in Q3 2024.

Complete 12 months 2024 Monetary Highlights

- Web Income was once $306.7 million, in comparison to $317.3 million in 2023, a decline of three.3% year-over-year.

- Gross Benefit Margin was once 48.9%, in comparison to 50.3% in 2023.

- GAAP Web loss from proceeding operations was once $72.7 million, in comparison to a internet loss from proceeding operations of $82.3 million in 2023; Web loss incorporated $47.8 million and $58.1 million of non-cash impairment fees for 2024 and 2023, respectively, basically associated with intangible and glued property within the Corporate’s Michigan industry unit.

- EBITDA from proceeding operations1 was once $3.3 million, in comparison to ($3.3) million in 2023.

- Adjusted EBITDA from proceeding operations1 was once $60.7 million, in comparison to $68.8 million in 2023.

- Adjusted EBITDA Margin from proceeding operations1 was once 19.8% in comparison to 21.7% in 2023.

- Web Money equipped by way of proceeding operations was once $38 million in comparison to $31.1 million in 2023.

- Loose Money Drift1 was once $28.6 million in comparison to $23.4 million in 2023.

“The industry carried out forward of our expectancies within the fourth quarter,” TerrAscend Government Chairman Jason Wild mentioned. “For 2024, we generated $307 million in earnings, $61 million in Adjusted EBITDA from proceeding operations, $38 million in sure running coins waft, and $29 million in loose coins waft. This efficiency was once pushed by way of our skill to reach a No. 1 marketplace percentage place in New Jersey for all quarters of 2024, expansion of our industry in Maryland from negligible earnings in early 2023 to a fourth-quarter 2024 run fee of over $70 million, whilst surpassing 50% gross margin, in addition to advanced gross margin in Pennsylvania, a state that I’m specifically occupied with in anticipation of proposed adult-use regulation

“All over the 12 months we finished a non-dilutive debt financing, aided by way of our $150 million of owned actual property, extending nearly all of our debt maturities to past due 2028. All of those accomplishments in 2024, together with reaching our 10th consecutive quarter of sure running coins waft and 6th consecutive quarter of sure loose coins waft, give us self assurance in our skill to force operational efficiencies and expansion of our core industry whilst judiciously pursuing a couple of greenfield growth alternatives at an increasing number of sexy costs.”

Monetary Abstract This fall 2024, Complete 12 months 2024 and Comparative Sessions

All comparative figures were restated to replicate the classification of the Canadian industry as discontinued operations in the course of the 3rd quarter of 2023. Monetary effects from the fourth quarter of 2023 onward replicate best proceeding operations.

1. EBITDA loss, EBITDA from proceeding operations, Adjusted EBITDA, Adjusted EBITDA from proceeding operations, Adjusted EBITDA margin, Adjusted EBITDA margin from proceeding operations, and Loose Money Drift are non-GAAP measures outlined within the segment titled “Definition and Reconciliation of Non-GAAP Measures” under and reconciled to essentially the most at once similar GAAP measure, at the top of this unencumber.

2024 Industry and Operational Highlights

- Accomplished tenth consecutive quarter of sure running coins waft and 6th consecutive quarter of sure loose coins waft within the fourth quarter of 2024.

- Signed definitive settlement to go into the corporate’s 6th state with the acquisition of Ohio Ratio Hashish, a well-situated and lately winning dispensary in Ohio. The transaction is predicted to near within the coming weeks, matter to regulatory approval.

- Maintained the No. 1 marketplace percentage place in New Jersey each quarter in 2024, in line with BDSA.

- All 3 New Jersey Apothecarium retail places have been ranked within the most sensible 10 out of roughly 200 places within the state, in line with Lit Signals2.

- Commenced growth of cultivation and production in Boonton, N.J., to beef up innovation and permit a broader product portfolio to fulfill shopper call for.

- Income grew sequentially in Maryland for all 4 quarters of 2024 whilst increasing gross margin from 25% to over 50%.

- Larger marketplace percentage place in Maryland from No. 13 within the fourth quarter of 2023 to No. 6 within the fourth quarter of 2024, in line with BDSA. The corporate is now only one.9 marketplace percentage issues clear of a No. 2 place within the state.

- Initiated growth of Maryland cultivation facility by way of including 4 further develop rooms with the 1st harvest anticipated all over the second one quarter of 2025.

- Commenced preparation for expected Pennsylvania adult-use implementation, leveraging the corporate’s 150,000-square-foot cultivation and production facility and Apothecarium retail community of six dispensaries.

- Closed on a senior secured time period mortgage for gross proceeds of $140 million, sporting an rate of interest of 12.75%, maturing in August 2028 and containing no warrants or prepayment consequences. The phrases of the mortgage have been aided by way of the corporate’s roughly $150 million of owned actual property.

- Initiated the first-ever percentage repurchase program in August 2024.

- Applied a company-wide ERP device, improving potency throughout departments and offering advanced information visibility and regulate.

- Finished a sequence of projects which are anticipated to cut back Common & Administrative bills year-over-year by way of a minimum of $10 million in 2025.

- Appointed Lynn Gefen, TerrAscend’s leader criminal officer, to an expanded position as leader other folks and criminal officer, and company secretary.

2. Information in accordance with general devices bought all over the fourth quarter of 2024.

Fourth Quarter 2024 Monetary Effects

Web earnings for the fourth quarter of 2024 was once $74.4 million as in comparison to $74.2 million for the 3rd quarter of 2024, representing quarter-over-quarter expansion of 0.3%. This expansion was once pushed by way of the corporate’s No. 1 marketplace percentage place in New Jersey blended with sequential earnings expansion in Maryland for the fourth consecutive quarter, partly offset by way of retail decline in Michigan.

Gross benefit margin for the fourth quarter of 2024 was once 50.2% as in comparison to 48.8% in the 3rd quarter of 2024. The quarter-over-quarter 140 basis-point growth was once pushed by way of enhancements in Maryland and Pennsylvania whilst New Jersey remained somewhat flat quarter-over-quarter.

Common & Administrative bills (G&A) for the fourth quarter of 2024 have been $28 million as in comparison to $31.6 million within the 3rd quarter of 2024. The $3.6 million sequential decline in G&A bills was once pushed by way of a $2.3 million relief in share-based reimbursement expense and $1.3 million of running expense discounts.

GAAP Web Loss was once $30.2 million, inclusive of $45.4 million of non-cash impairment fees associated with the corporate’s Michigan industry, in comparison to a internet lack of $21.4 million within the 3rd quarter of 2024.

Adjusted EBITDA, a non-GAAP measure, was once $15.1 million, a 20.3% Adjusted EBITDA margin, as in comparison to $13.7 million, an 18.5% Adjusted EBITDA margin, within the 3rd quarter of 2024. The quarter-over-quarter build up was once pushed by way of gross margin growth and G&A expense relief.

Complete 12 months 2024 Monetary Effects

Web earnings for the entire 12 months 2024 was once $306.7 million, in comparison to $317.3 million for the entire 12 months 2023. The year-over-year decline was once basically pushed by way of a decline in retail gross sales in Michigan and New Jersey. The decline in retail gross sales in Michigan was once pushed by way of lowered foot visitors associated with discounts in discounting and promotions pushed by way of the corporate’s ongoing efforts to extend gross margin. The decline in New Jersey was once pushed by way of an build up in retail pageant associated with retailer openings around the state. Those declines have been partly offset by way of wholesale earnings expansion in New Jersey and Pennsylvania and each retail and wholesale earnings expansion in Maryland because of a complete 12 months of adult-use gross sales and marketplace percentage beneficial properties in that state.

Gross benefit margin for the entire 12 months 2024 was once 48.9% as in comparison to 50.3% for the complete 12 months 2023. The decline in gross margin was once pushed by way of worth compression in New Jersey and Pennsylvania, partly offset by way of margin development in Maryland associated with the corporate’s growth and endured productiveness beneficial properties and price discounts in that marketplace.

G&A bills for the entire 12 months 2024 have been $111.6 million in comparison to $115.2 million in 2023, representing a three% decline in G&A bills year-over-year. This relief in G&A bills was once associated with the corporate’s ongoing projects to optimize its G&A bills. G&A as a p.c of earnings was once unchanged as opposed to the prior 12 months at 36.3%.

Web loss from proceeding operations for the entire 12 months 2024 was once $72.7 million in comparison to a internet lack of $82.3 million in 2023. Each 2024 and 2023 incorporated $47.8 million and $58.1 million, respectively, of non-cash impairment fees basically associated with intangible and glued property within the corporation’s Michigan industry unit.

Complete-year 2024 Adjusted EBITDA from proceeding operations, a non-GAAP measure, was once $60.7 million in comparison to $68.8 million in 2023. The year-over-year trade in Adjusted EBITDA from proceeding operations was once pushed by way of decrease earnings and gross benefit margin, partly offset by way of decrease G&A bills year-over-year. Adjusted EBITDA margin from proceeding operations for the entire 12 months was once 19.8% as in comparison to 21.7% in 2023.

Steadiness Sheet and Money Drift

Money and coins equivalents, together with $600,000 of limited coins, have been $27 million as of Dec. 31, 2024, in comparison to $27.2 million as of Sept. 30, 2024. Web coins equipped by way of running actions was once $9.7 million for the fourth quarter of 2024 in comparison to $1.8 million within the 3rd quarter of 2024. This represented the corporate’s tenth consecutive quarter of sure coins waft from proceeding operations. Capex spending was once $4.7 million within the fourth quarter of 2024, basically associated with the corporate’s expansions at its amenities in New Jersey and Maryland. Loose coins waft was once $5 million in comparison to $1.5 million within the 3rd quarter of 2024, representing the corporate’s 6th consecutive quarter of sure loose coins waft. All over the quarter, the corporate dispensed $2.9 million to its New Jersey companions and made $1.4 million of most important bills on its debt.

As of March 5, 2025, there have been roughly 369 million fundamental stocks of the corporate issued and remarkable, together with 292 million commonplace stocks, 13 million most well-liked stocks as transformed, and 63 million exchangeable stocks. Moreover, there have been 43.1 million warrants and choices remarkable at a weighted moderate worth of $3.90.

[PRESS RELEASE] – TORONTO, March 6, 2025 – TerrAscend Corp., a number one North American hashish corporation, reported its monetary effects for the fourth quarter and entire 12 months ended Dec. 31, 2024. All quantities are expressed in U.S. bucks and are ready underneath U.S. most often accredited accounting rules (GAAP), until indicated differently.

The following monetary measures with recognize to the entire 12 months 2024 are reported as effects from proceeding operations because of the shutdown of the authorized manufacturer industry in Canada, which is reported as discontinued operations via Sept. 30, 2023. All ancient classes were restated accordingly.

Fourth Quarter 2024 Monetary Highlights

- Web Income was once $74.4 million, in comparison to $74.2 million in Q3 2024, an build up of 0.3% quarter-over-quarter.

- Gross Benefit Margin was once 50.2%, up 140 foundation issues in comparison to 48.8% in Q3 2024.

- GAAP Web loss was once $30.2 million, in comparison to a internet lack of $21.4 million in Q3 2024; This fall 2024 internet loss incorporated a $45.4 million non-cash impairment price associated with the corporate’s Michigan industry.

- EBITDA1 loss was once $30.6 million, in comparison to $6.6 million in Q3 2024; This fall 2024 loss incorporated a $45.4 million non-cash impairment price basically associated with the corporate’s Michigan industry.

- Adjusted EBITDA1 was once $15.1 million, in comparison to $13.7 million in Q3 2024.

- Adjusted EBITDA Margin1 was once 20.3%, in comparison to 18.5% in Q3 2024.

- Web Money equipped by way of running actions was once $9.7 million, in comparison to $1.8 million in Q3 2024.

- Loose Money Drift1 was once $5 million, when compared to $1.5 million in Q3 2024.

Complete 12 months 2024 Monetary Highlights

- Web Income was once $306.7 million, in comparison to $317.3 million in 2023, a decline of three.3% year-over-year.

- Gross Benefit Margin was once 48.9%, in comparison to 50.3% in 2023.

- GAAP Web loss from proceeding operations was once $72.7 million, in comparison to a internet loss from proceeding operations of $82.3 million in 2023; Web loss incorporated $47.8 million and $58.1 million of non-cash impairment fees for 2024 and 2023, respectively, basically associated with intangible and glued property within the Corporate’s Michigan industry unit.

- EBITDA from proceeding operations1 was once $3.3 million, in comparison to ($3.3) million in 2023.

- Adjusted EBITDA from proceeding operations1 was once $60.7 million, in comparison to $68.8 million in 2023.

- Adjusted EBITDA Margin from proceeding operations1 was once 19.8% in comparison to 21.7% in 2023.

- Web Money equipped by way of proceeding operations was once $38 million in comparison to $31.1 million in 2023.

- Loose Money Drift1 was once $28.6 million in comparison to $23.4 million in 2023.

“The industry carried out forward of our expectancies within the fourth quarter,” TerrAscend Government Chairman Jason Wild mentioned. “For 2024, we generated $307 million in earnings, $61 million in Adjusted EBITDA from proceeding operations, $38 million in sure running coins waft, and $29 million in loose coins waft. This efficiency was once pushed by way of our skill to reach a No. 1 marketplace percentage place in New Jersey for all quarters of 2024, expansion of our industry in Maryland from negligible earnings in early 2023 to a fourth-quarter 2024 run fee of over $70 million, whilst surpassing 50% gross margin, in addition to advanced gross margin in Pennsylvania, a state that I’m specifically occupied with in anticipation of proposed adult-use regulation

“All over the 12 months we finished a non-dilutive debt financing, aided by way of our $150 million of owned actual property, extending nearly all of our debt maturities to past due 2028. All of those accomplishments in 2024, together with reaching our 10th consecutive quarter of sure running coins waft and 6th consecutive quarter of sure loose coins waft, give us self assurance in our skill to force operational efficiencies and expansion of our core industry whilst judiciously pursuing a couple of greenfield growth alternatives at an increasing number of sexy costs.”

Monetary Abstract This fall 2024, Complete 12 months 2024 and Comparative Sessions

All comparative figures were restated to replicate the classification of the Canadian industry as discontinued operations in the course of the 3rd quarter of 2023. Monetary effects from the fourth quarter of 2023 onward replicate best proceeding operations.

1. EBITDA loss, EBITDA from proceeding operations, Adjusted EBITDA, Adjusted EBITDA from proceeding operations, Adjusted EBITDA margin, Adjusted EBITDA margin from proceeding operations, and Loose Money Drift are non-GAAP measures outlined within the segment titled “Definition and Reconciliation of Non-GAAP Measures” under and reconciled to essentially the most at once similar GAAP measure, at the top of this unencumber.

2024 Industry and Operational Highlights

- Accomplished tenth consecutive quarter of sure running coins waft and 6th consecutive quarter of sure loose coins waft within the fourth quarter of 2024.

- Signed definitive settlement to go into the corporate’s 6th state with the acquisition of Ohio Ratio Hashish, a well-situated and lately winning dispensary in Ohio. The transaction is predicted to near within the coming weeks, matter to regulatory approval.

- Maintained the No. 1 marketplace percentage place in New Jersey each quarter in 2024, in line with BDSA.

- All 3 New Jersey Apothecarium retail places have been ranked within the most sensible 10 out of roughly 200 places within the state, in line with Lit Signals2.

- Commenced growth of cultivation and production in Boonton, N.J., to beef up innovation and permit a broader product portfolio to fulfill shopper call for.

- Income grew sequentially in Maryland for all 4 quarters of 2024 whilst increasing gross margin from 25% to over 50%.

- Larger marketplace percentage place in Maryland from No. 13 within the fourth quarter of 2023 to No. 6 within the fourth quarter of 2024, in line with BDSA. The corporate is now only one.9 marketplace percentage issues clear of a No. 2 place within the state.

- Initiated growth of Maryland cultivation facility by way of including 4 further develop rooms with the 1st harvest anticipated all over the second one quarter of 2025.

- Commenced preparation for expected Pennsylvania adult-use implementation, leveraging the corporate’s 150,000-square-foot cultivation and production facility and Apothecarium retail community of six dispensaries.

- Closed on a senior secured time period mortgage for gross proceeds of $140 million, sporting an rate of interest of 12.75%, maturing in August 2028 and containing no warrants or prepayment consequences. The phrases of the mortgage have been aided by way of the corporate’s roughly $150 million of owned actual property.

- Initiated the first-ever percentage repurchase program in August 2024.

- Applied a company-wide ERP device, improving potency throughout departments and offering advanced information visibility and regulate.

- Finished a sequence of projects which are anticipated to cut back Common & Administrative bills year-over-year by way of a minimum of $10 million in 2025.

- Appointed Lynn Gefen, TerrAscend’s leader criminal officer, to an expanded position as leader other folks and criminal officer, and company secretary.

2. Information in accordance with general devices bought all over the fourth quarter of 2024.

Fourth Quarter 2024 Monetary Effects

Web earnings for the fourth quarter of 2024 was once $74.4 million as in comparison to $74.2 million for the 3rd quarter of 2024, representing quarter-over-quarter expansion of 0.3%. This expansion was once pushed by way of the corporate’s No. 1 marketplace percentage place in New Jersey blended with sequential earnings expansion in Maryland for the fourth consecutive quarter, partly offset by way of retail decline in Michigan.

Gross benefit margin for the fourth quarter of 2024 was once 50.2% as in comparison to 48.8% in the 3rd quarter of 2024. The quarter-over-quarter 140 basis-point growth was once pushed by way of enhancements in Maryland and Pennsylvania whilst New Jersey remained somewhat flat quarter-over-quarter.

Common & Administrative bills (G&A) for the fourth quarter of 2024 have been $28 million as in comparison to $31.6 million within the 3rd quarter of 2024. The $3.6 million sequential decline in G&A bills was once pushed by way of a $2.3 million relief in share-based reimbursement expense and $1.3 million of running expense discounts.

GAAP Web Loss was once $30.2 million, inclusive of $45.4 million of non-cash impairment fees associated with the corporate’s Michigan industry, in comparison to a internet lack of $21.4 million within the 3rd quarter of 2024.

Adjusted EBITDA, a non-GAAP measure, was once $15.1 million, a 20.3% Adjusted EBITDA margin, as in comparison to $13.7 million, an 18.5% Adjusted EBITDA margin, within the 3rd quarter of 2024. The quarter-over-quarter build up was once pushed by way of gross margin growth and G&A expense relief.

Complete 12 months 2024 Monetary Effects

Web earnings for the entire 12 months 2024 was once $306.7 million, in comparison to $317.3 million for the entire 12 months 2023. The year-over-year decline was once basically pushed by way of a decline in retail gross sales in Michigan and New Jersey. The decline in retail gross sales in Michigan was once pushed by way of lowered foot visitors associated with discounts in discounting and promotions pushed by way of the corporate’s ongoing efforts to extend gross margin. The decline in New Jersey was once pushed by way of an build up in retail pageant associated with retailer openings around the state. Those declines have been partly offset by way of wholesale earnings expansion in New Jersey and Pennsylvania and each retail and wholesale earnings expansion in Maryland because of a complete 12 months of adult-use gross sales and marketplace percentage beneficial properties in that state.

Gross benefit margin for the entire 12 months 2024 was once 48.9% as in comparison to 50.3% for the complete 12 months 2023. The decline in gross margin was once pushed by way of worth compression in New Jersey and Pennsylvania, partly offset by way of margin development in Maryland associated with the corporate’s growth and endured productiveness beneficial properties and price discounts in that marketplace.

G&A bills for the entire 12 months 2024 have been $111.6 million in comparison to $115.2 million in 2023, representing a three% decline in G&A bills year-over-year. This relief in G&A bills was once associated with the corporate’s ongoing projects to optimize its G&A bills. G&A as a p.c of earnings was once unchanged as opposed to the prior 12 months at 36.3%.

Web loss from proceeding operations for the entire 12 months 2024 was once $72.7 million in comparison to a internet lack of $82.3 million in 2023. Each 2024 and 2023 incorporated $47.8 million and $58.1 million, respectively, of non-cash impairment fees basically associated with intangible and glued property within the corporation’s Michigan industry unit.

Complete-year 2024 Adjusted EBITDA from proceeding operations, a non-GAAP measure, was once $60.7 million in comparison to $68.8 million in 2023. The year-over-year trade in Adjusted EBITDA from proceeding operations was once pushed by way of decrease earnings and gross benefit margin, partly offset by way of decrease G&A bills year-over-year. Adjusted EBITDA margin from proceeding operations for the entire 12 months was once 19.8% as in comparison to 21.7% in 2023.

Steadiness Sheet and Money Drift

Money and coins equivalents, together with $600,000 of limited coins, have been $27 million as of Dec. 31, 2024, in comparison to $27.2 million as of Sept. 30, 2024. Web coins equipped by way of running actions was once $9.7 million for the fourth quarter of 2024 in comparison to $1.8 million within the 3rd quarter of 2024. This represented the corporate’s tenth consecutive quarter of sure coins waft from proceeding operations. Capex spending was once $4.7 million within the fourth quarter of 2024, basically associated with the corporate’s expansions at its amenities in New Jersey and Maryland. Loose coins waft was once $5 million in comparison to $1.5 million within the 3rd quarter of 2024, representing the corporate’s 6th consecutive quarter of sure loose coins waft. All over the quarter, the corporate dispensed $2.9 million to its New Jersey companions and made $1.4 million of most important bills on its debt.

As of March 5, 2025, there have been roughly 369 million fundamental stocks of the corporate issued and remarkable, together with 292 million commonplace stocks, 13 million most well-liked stocks as transformed, and 63 million exchangeable stocks. Moreover, there have been 43.1 million warrants and choices remarkable at a weighted moderate worth of $3.90.