[PRESS RELEASE] – TORONTO, Would possibly 8, 2025 – TerrAscend Corp., a number one North American hashish corporate, reported its monetary effects for the primary quarter ended March 31, 2025. All quantities are expressed in U.S. greenbacks and are ready underneath U.S. usually approved accounting ideas (GAAP) until indicated in a different way.

First Quarter 2025 Monetary Highlights

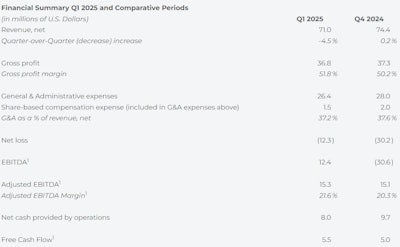

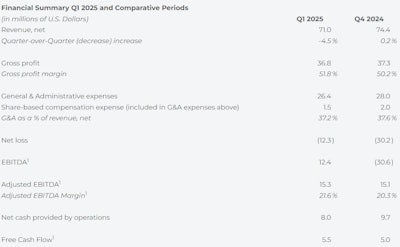

- Web income was once $71 million, in comparison to $74.4 million in This fall 2024, reflecting a 4.5% seasonal decline.

- Gross benefit margin was once 51.8%, up 160 foundation issues in comparison to 50.2% in This fall 2024.

- GAAP internet loss was once $12.3 million, in comparison to a internet lack of $30.2 million in This fall 2024.

- EBITDA¹ was once $12.4 million, in comparison to an EBITDA lack of $30.6 million in This fall 2024.

- Adjusted EBITDA¹ was once $15.3 million, in comparison to $15.1 million in This fall 2024.

- Adjusted EBITDA Margin¹ was once 21.6%, in comparison to 20.3% in This fall 2024.

- Web money supplied through running actions was once $8 million, in comparison to $9.7 million in This fall 2024.

- Loose money flow¹ was once $5.5 million, in comparison to $5 million in This fall 2024.

“In spite of a difficult business atmosphere, income carried out in keeping with our steerage, whilst gross margin and EBITDA margin outperformed our expectancies all the way through the primary quarter of 2025,” TerrAscend Government Chairman Jason Wild stated. “Earnings totaled $71 million, a sequential decline of four.5%, essentially because of seasonality, whilst gross benefit margin larger to 51.8% and changed EBITDA margin stepped forward to 21.6%. Those effects have been pushed through sturdy income enlargement and margin growth in Maryland, in conjunction with our endured management within the New Jersey marketplace. Normal and administrative bills declined through an extra $1.6 million in Q1, following a $3.6 million aid in This fall 2024, as a part of our ongoing G&A discount program aimed toward attaining $10 million in year-over-year financial savings for 2025.

“Following the top of the quarter, we finished the acquisition of a dispensary in Ohio, increasing our footprint to 6 U.S. states. We additionally introduced a definitive settlement to obtain a fourth dispensary in New Jersey, pending regulatory approval. Our endured accomplishments, together with our 11th consecutive quarter of sure running money drift and 7th consecutive quarter of sure loose money drift, mirror the energy of our trade. Mixed with a strong stability sheet, over $150 million in owned actual property, minimum leaseback tasks, and no vital debt maturities till overdue 2028, we’re well-positioned to power additional operational efficiencies, develop our core trade, and strategically pursue further acquisitions at an increasing number of horny valuations.”

First Quarter 2025 Trade and Operational Highlights

- Accomplished eleventh consecutive quarter of sure running money drift and 7th consecutive quarter of sure loose money drift.

- Maintained a management place in New Jersey.2

- Made vital development with the growth of cultivation and production features in New Jersey.

- Additional stepped forward marketplace percentage place in Maryland and now just one.4 marketplace percentage issues clear of the No. 2 place within the state.2

- Expanded Maryland cultivation capability through an extra 50% with the primary harvest anticipated in overdue June.

- Persevered arrangements for doable Pennsylvania adult-use implementation, leveraging the corporate’s 150,000-square-foot cultivation and production facility and Apothecarium retail community of six dispensaries.

- Finished a sequence of tasks anticipated to scale back common and administrative bills year-over-year in 2025 through no less than $10 million.

- Repurchased 637,000 stocks as a part of the $10 million percentage repurchase program initiated in August of 2024.

Next Occasions

- Finished the purchase of Ratio Hashish, a well-situated and winning dispensary in Ohio, marking the corporate’s front into its 6th state.

- Signed a definitive settlement to obtain a high-performing dispensary in New Jersey, which, upon ultimate, would carry TerrAscend’s general choice of dispensaries as much as 4 within the state.

1. EBITDA, adjusted EBITDA, adjusted EBITDA margin and loose money drift are non-GAAP measures outlined within the phase titled “Definition and Reconciliation of Non-GAAP Measures” underneath and reconciled to probably the most without delay similar GAAP measure on the finish of this unencumber.

2. In step with BDSA.

First Quarter 2025 Monetary Effects

Web income for the primary quarter of 2025 was once $71 million, a 4.5% lower sequentially, as anticipated, in large part because of seasonality, as in comparison to $74.4 million for the fourth quarter of 2024. Retail income diminished 6.4% sequentially, whilst wholesale income was once flat. Pennsylvania and Maryland retail gross sales have been flat to relatively up sequentially, whilst seasonal declines took place in Michigan and New Jersey. In wholesale, sequential enlargement in Pennsylvania and Maryland was once offset through a decline in New Jersey.

Gross benefit margin for the primary quarter of 2025 was once 51.8%, in comparison to 50.2% within the fourth quarter of 2024 and 48% within the first quarter of 2024. The quarter-over-quarter 160 basis-point growth was once pushed through enhancements in Maryland, Pennsylvania and Michigan, whilst New Jersey remained somewhat flat quarter-over-quarter.

Normal and administrative (G&A) bills for the primary quarter have been $26.4 million in comparison to $28 million within the fourth quarter of 2024. G&A bills diminished through an extra $1.6 million within the first quarter, following a $3.6 million aid within the fourth quarter of 2024. This endured G&A expense aid over the last two quarters displays the corporate’s ongoing tasks to optimize G&A bills, which can be anticipated to scale back G&A through $10 million year-over-year in 2025.

GAAP internet loss for the primary quarter of 2025 was once $12.3 million, in comparison to a internet lack of $30.2 million within the fourth quarter of 2024.

Adjusted EBITDA, a non-GAAP measure, was once $15.3 million for the primary quarter of 2025, or 21.6% of income, in comparison to $15.1 million, or 20.3% of income, within the fourth quarter of 2024. The sequential growth in adjusted EBITDA margin was once essentially pushed through gross margin growth and decrease G&A bills.

Steadiness Sheet and Money Drift

Money and money equivalents have been $29.4 million as of March 31, 2025, in comparison to $26.4 million as of Dec. 31, 2024. Web money supplied through running actions within the first quarter of 2025 was once $8 million, in comparison to $9.7 million within the fourth quarter of 2024. This represented the corporate’s eleventh consecutive quarter of sure money drift from operations. Capex spending was once $2.5 million within the first quarter of 2025, basically associated with expansions on the corporate’s Maryland and New Jersey amenities. The 50% growth of cultivation in Hagerstown, Md., was once finished in April, with the primary harvest anticipated in overdue June. The expanded edibles manufacturing in Boonton, N.J., was once finished in early Would possibly. Loose money drift was once $5.5 million within the first quarter of 2025, in comparison to $5 million within the fourth quarter of 2024, representing the corporate’s 7th consecutive quarter of sure loose money drift. All over the quarter, the corporate made $0.7 million of distributions to its New Jersey minority companions and paid down $1 million of debt.

As of March 31, 2025, there have been roughly 369 million fundamental stocks of the corporate issued and exceptional, together with 293 million commonplace stocks, 13 million most popular stocks as transformed, and 63 million exchangeable stocks. Moreover, there have been 42 million warrants and choices exceptional at a weighted reasonable worth of $3.57.

Definition and Reconciliation of Non-GAAP Measures

Along with reporting the monetary ends up in accordance with GAAP, the corporate stories positive monetary effects that vary from what’s reported underneath GAAP. Non-GAAP measures utilized by control would not have any standardized that means prescribed through GAAP and will not be similar to identical measures offered through different corporations. The corporate believes that positive traders and analysts use those measures to measure an organization’s skill to fulfill different cost tasks or as a commonplace dimension to price corporations within the hashish business, and the corporate calculates: (i) Loose money drift from internet money supplied through running actions much less capital expenditures for assets and kit which control believes is a very powerful dimension of the corporate’s skill to generate more cash from its trade operations, and (ii) EBITDA and changed EBITDA as internet loss, adjusted to exclude provision for source of revenue taxes, finance bills, depreciation and amortization, share-based repayment, loss (achieve) from revaluation of contingent attention, achieve on disposal of fastened property, impairment of goodwill and intangible property, impairment of assets and kit and proper of use property, unrealized and discovered loss on investments, achieve on derecognition of proper of use property, unrealized and discovered foreign currency loss, achieve on honest worth of by-product liabilities and buy choice by-product property, and likely different pieces, which control believes isn’t reflective of the continued operations and function of the corporate. Such knowledge is meant to supply more information and will have to now not be regarded as in isolation or as an alternative to measures of efficiency ready based on GAAP.

[PRESS RELEASE] – TORONTO, Would possibly 8, 2025 – TerrAscend Corp., a number one North American hashish corporate, reported its monetary effects for the primary quarter ended March 31, 2025. All quantities are expressed in U.S. greenbacks and are ready underneath U.S. usually approved accounting ideas (GAAP) until indicated in a different way.

First Quarter 2025 Monetary Highlights

- Web income was once $71 million, in comparison to $74.4 million in This fall 2024, reflecting a 4.5% seasonal decline.

- Gross benefit margin was once 51.8%, up 160 foundation issues in comparison to 50.2% in This fall 2024.

- GAAP internet loss was once $12.3 million, in comparison to a internet lack of $30.2 million in This fall 2024.

- EBITDA¹ was once $12.4 million, in comparison to an EBITDA lack of $30.6 million in This fall 2024.

- Adjusted EBITDA¹ was once $15.3 million, in comparison to $15.1 million in This fall 2024.

- Adjusted EBITDA Margin¹ was once 21.6%, in comparison to 20.3% in This fall 2024.

- Web money supplied through running actions was once $8 million, in comparison to $9.7 million in This fall 2024.

- Loose money flow¹ was once $5.5 million, in comparison to $5 million in This fall 2024.

“In spite of a difficult business atmosphere, income carried out in keeping with our steerage, whilst gross margin and EBITDA margin outperformed our expectancies all the way through the primary quarter of 2025,” TerrAscend Government Chairman Jason Wild stated. “Earnings totaled $71 million, a sequential decline of four.5%, essentially because of seasonality, whilst gross benefit margin larger to 51.8% and changed EBITDA margin stepped forward to 21.6%. Those effects have been pushed through sturdy income enlargement and margin growth in Maryland, in conjunction with our endured management within the New Jersey marketplace. Normal and administrative bills declined through an extra $1.6 million in Q1, following a $3.6 million aid in This fall 2024, as a part of our ongoing G&A discount program aimed toward attaining $10 million in year-over-year financial savings for 2025.

“Following the top of the quarter, we finished the acquisition of a dispensary in Ohio, increasing our footprint to 6 U.S. states. We additionally introduced a definitive settlement to obtain a fourth dispensary in New Jersey, pending regulatory approval. Our endured accomplishments, together with our 11th consecutive quarter of sure running money drift and 7th consecutive quarter of sure loose money drift, mirror the energy of our trade. Mixed with a strong stability sheet, over $150 million in owned actual property, minimum leaseback tasks, and no vital debt maturities till overdue 2028, we’re well-positioned to power additional operational efficiencies, develop our core trade, and strategically pursue further acquisitions at an increasing number of horny valuations.”

First Quarter 2025 Trade and Operational Highlights

- Accomplished eleventh consecutive quarter of sure running money drift and 7th consecutive quarter of sure loose money drift.

- Maintained a management place in New Jersey.2

- Made vital development with the growth of cultivation and production features in New Jersey.

- Additional stepped forward marketplace percentage place in Maryland and now just one.4 marketplace percentage issues clear of the No. 2 place within the state.2

- Expanded Maryland cultivation capability through an extra 50% with the primary harvest anticipated in overdue June.

- Persevered arrangements for doable Pennsylvania adult-use implementation, leveraging the corporate’s 150,000-square-foot cultivation and production facility and Apothecarium retail community of six dispensaries.

- Finished a sequence of tasks anticipated to scale back common and administrative bills year-over-year in 2025 through no less than $10 million.

- Repurchased 637,000 stocks as a part of the $10 million percentage repurchase program initiated in August of 2024.

Next Occasions

- Finished the purchase of Ratio Hashish, a well-situated and winning dispensary in Ohio, marking the corporate’s front into its 6th state.

- Signed a definitive settlement to obtain a high-performing dispensary in New Jersey, which, upon ultimate, would carry TerrAscend’s general choice of dispensaries as much as 4 within the state.

1. EBITDA, adjusted EBITDA, adjusted EBITDA margin and loose money drift are non-GAAP measures outlined within the phase titled “Definition and Reconciliation of Non-GAAP Measures” underneath and reconciled to probably the most without delay similar GAAP measure on the finish of this unencumber.

2. In step with BDSA.

First Quarter 2025 Monetary Effects

Web income for the primary quarter of 2025 was once $71 million, a 4.5% lower sequentially, as anticipated, in large part because of seasonality, as in comparison to $74.4 million for the fourth quarter of 2024. Retail income diminished 6.4% sequentially, whilst wholesale income was once flat. Pennsylvania and Maryland retail gross sales have been flat to relatively up sequentially, whilst seasonal declines took place in Michigan and New Jersey. In wholesale, sequential enlargement in Pennsylvania and Maryland was once offset through a decline in New Jersey.

Gross benefit margin for the primary quarter of 2025 was once 51.8%, in comparison to 50.2% within the fourth quarter of 2024 and 48% within the first quarter of 2024. The quarter-over-quarter 160 basis-point growth was once pushed through enhancements in Maryland, Pennsylvania and Michigan, whilst New Jersey remained somewhat flat quarter-over-quarter.

Normal and administrative (G&A) bills for the primary quarter have been $26.4 million in comparison to $28 million within the fourth quarter of 2024. G&A bills diminished through an extra $1.6 million within the first quarter, following a $3.6 million aid within the fourth quarter of 2024. This endured G&A expense aid over the last two quarters displays the corporate’s ongoing tasks to optimize G&A bills, which can be anticipated to scale back G&A through $10 million year-over-year in 2025.

GAAP internet loss for the primary quarter of 2025 was once $12.3 million, in comparison to a internet lack of $30.2 million within the fourth quarter of 2024.

Adjusted EBITDA, a non-GAAP measure, was once $15.3 million for the primary quarter of 2025, or 21.6% of income, in comparison to $15.1 million, or 20.3% of income, within the fourth quarter of 2024. The sequential growth in adjusted EBITDA margin was once essentially pushed through gross margin growth and decrease G&A bills.

Steadiness Sheet and Money Drift

Money and money equivalents have been $29.4 million as of March 31, 2025, in comparison to $26.4 million as of Dec. 31, 2024. Web money supplied through running actions within the first quarter of 2025 was once $8 million, in comparison to $9.7 million within the fourth quarter of 2024. This represented the corporate’s eleventh consecutive quarter of sure money drift from operations. Capex spending was once $2.5 million within the first quarter of 2025, basically associated with expansions on the corporate’s Maryland and New Jersey amenities. The 50% growth of cultivation in Hagerstown, Md., was once finished in April, with the primary harvest anticipated in overdue June. The expanded edibles manufacturing in Boonton, N.J., was once finished in early Would possibly. Loose money drift was once $5.5 million within the first quarter of 2025, in comparison to $5 million within the fourth quarter of 2024, representing the corporate’s 7th consecutive quarter of sure loose money drift. All over the quarter, the corporate made $0.7 million of distributions to its New Jersey minority companions and paid down $1 million of debt.

As of March 31, 2025, there have been roughly 369 million fundamental stocks of the corporate issued and exceptional, together with 293 million commonplace stocks, 13 million most popular stocks as transformed, and 63 million exchangeable stocks. Moreover, there have been 42 million warrants and choices exceptional at a weighted reasonable worth of $3.57.

Definition and Reconciliation of Non-GAAP Measures

Along with reporting the monetary ends up in accordance with GAAP, the corporate stories positive monetary effects that vary from what’s reported underneath GAAP. Non-GAAP measures utilized by control would not have any standardized that means prescribed through GAAP and will not be similar to identical measures offered through different corporations. The corporate believes that positive traders and analysts use those measures to measure an organization’s skill to fulfill different cost tasks or as a commonplace dimension to price corporations within the hashish business, and the corporate calculates: (i) Loose money drift from internet money supplied through running actions much less capital expenditures for assets and kit which control believes is a very powerful dimension of the corporate’s skill to generate more cash from its trade operations, and (ii) EBITDA and changed EBITDA as internet loss, adjusted to exclude provision for source of revenue taxes, finance bills, depreciation and amortization, share-based repayment, loss (achieve) from revaluation of contingent attention, achieve on disposal of fastened property, impairment of goodwill and intangible property, impairment of assets and kit and proper of use property, unrealized and discovered loss on investments, achieve on derecognition of proper of use property, unrealized and discovered foreign currency loss, achieve on honest worth of by-product liabilities and buy choice by-product property, and likely different pieces, which control believes isn’t reflective of the continued operations and function of the corporate. Such knowledge is meant to supply more information and will have to now not be regarded as in isolation or as an alternative to measures of efficiency ready based on GAAP.