[PRESS RELEASE] – NORWOOD, Mass., March 5, 2025 – MariMed Inc., a number one multistate hashish operator enthusiastic about bettering lives each day, introduced its monetary effects for the fourth quarter and yr ended Dec. 31, 2024.

MariMed CEO Jon Levine stated, “We’re happy to record document revenues and progressed adjusted EBITDA for MariMed. I proceed to imagine we personal probably the most most powerful portfolios of hashish manufacturers within the trade, which helped us power annual wholesale profit enlargement of 29 p.c. Our manufacturers proceed to achieve marketplace proportion in all our core markets, with Betty’s Eddies fruit chews lately the top-selling suitable for eating in Massachusetts and Maryland.

“Having a look forward to 2025, now we have quite a few levers to gasoline our enlargement, together with: a complete yr of economic contribution after finishing the build-out or growth of 10 revenue-generating belongings over the last two years; persevered wholesale beneficial properties in Illinois, Missouri, and Maryland; the consolidation of Delaware’s First State Compassion Middle into MariMed because the state prepares for adult-use gross sales; and accretive M&A process that can improve expanded marketplace penetration for our manufacturers in new and current states.”

MariMed Leader Monetary Officer Mario Pinho stated, “MariMed continues to deal with one in every of the most powerful stability sheets within the hashish trade, and we’re happy to record that we effectively accomplished our revised 2024 monetary steering for profit enlargement and altered EBITDA. Having a look forward, we’re well-positioned to leverage our manufacturers and skill to power persevered top-line enlargement and extra give a boost to profitability in 2025. As we navigate the evolving trade panorama, we stay enthusiastic about executing our process of handing over the most productive manufacturers to our consumers and handing over long-term price to our shareholders.”

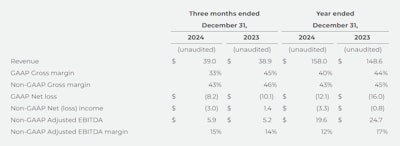

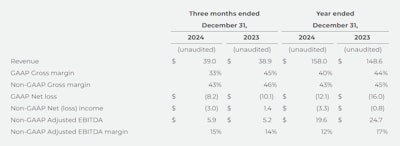

Monetary Highlights1

The following desk summarizes the corporate’s consolidated monetary highlights (in thousands and thousands, apart from proportion quantities):

1 See the reconciliations of non-GAAP monetary measures to essentially the most at once similar GAAP measures and extra details about non-GAAP measures within the segment entitled “Dialogue of Non-GAAP Monetary Measures” beneath and within the financials data incorporated herewith.

Fourth Quarter 2024 Operational Highlights

All over the fourth quarter, the corporate introduced the next tendencies within the implementation of its strategic enlargement plan:

- Oct. 14: Commenced rising operations in its new cultivation facility in Mt. Vernon, Sick. The new facility lets in the corporate to develop its award-winning, high quality Nature’s Heritage flower for distribution right through the state. The corporate expects the primary harvest to be on cabinets this month.

- Oct. 30: Introduced the graduation of producing operations in Missouri. The corporate started wholesale distribution of its branded merchandise right through the state in overdue December 2024.

Different Trends

Next to the tip of the fourth quarter, the corporate introduced the next construction:

- March 3: The state of Delaware authorized the corporate as the landlord of First State Compassion Middle (FSCC), the state’s main vertical hashish operator. Previous to the consolidation of FSCC’s cultivation and processing amenities and two dispensaries into MariMed, the corporate have been offering control services and products to FSCC since 2014.

Dialogue of non-GAAP Monetary Measures

MariMed’s control makes use of a number of other monetary measures, each GAAP and non-GAAP, in examining and assessing the total efficiency of its trade, making running selections, and making plans and forecasting long run sessions. The corporate has supplied on this unencumber a number of non-GAAP monetary measures: Non-GAAP Gross margin, Non-GAAP Internet source of revenue (loss), Non-GAAP Adjusted EBITDA and non-GAAP Adjusted EBITDA margin, as dietary supplements to Earnings, Gross margin, Internet (loss) source of revenue and different monetary measures ready in line with GAAP.

Control believes those non-GAAP monetary measures are helpful in reviewing and assessing the efficiency of the corporate, and when making plans and forecasting long run sessions, as they supply significant running effects by way of aside from the results of bills that don’t seem to be reflective of its running trade efficiency. As well as, the corporate’s control makes use of those non-GAAP monetary measures to know and evaluate running effects throughout accounting sessions and for monetary and operational decision-making. The presentation of those non-GAAP measures isn’t meant to be regarded as in isolation or as an alternative choice to the monetary data ready in accordance with GAAP.

Control believes that buyers and analysts take pleasure in making an allowance for non-GAAP monetary measures in assessing the corporate’s monetary effects and its ongoing trade, because it lets in for significant comparisons and research of traits within the trade. Specifically, non-GAAP adjusted EBITDA is utilized by many buyers and analysts themselves, along side different metrics, to check monetary effects throughout accounting sessions and to these of peer corporations.

As there aren’t any standardized strategies of calculating non-GAAP monetary measures, the corporate’s calculations would possibly range from the ones utilized by analysts, buyers and different corporations, even the ones inside the hashish trade, and subsequently would possibly now not be at once similar to in a similar fashion titled measures utilized by others.

Control defines non-GAAP Adjusted EBITDA as source of revenue from operations, made up our minds in accordance with GAAP, aside from the next pieces:

- depreciation of mounted belongings;

- amortization of bought intangible belongings;

- Impairment or write-downs of intangible belongings;

- stock revaluation;

- stock-based reimbursement;

- severance;

- criminal settlements; and

- acquisition-related and different bills.

For additional data, please seek advice from the publicly to be had monetary filings to be had on MariMed’s Investor Members of the family web site, as filed with the U.S. Securities and Alternate Fee, or as filed with the Canadian securities regulatory government at the SEDAR web site.

[PRESS RELEASE] – NORWOOD, Mass., March 5, 2025 – MariMed Inc., a number one multistate hashish operator enthusiastic about bettering lives each day, introduced its monetary effects for the fourth quarter and yr ended Dec. 31, 2024.

MariMed CEO Jon Levine stated, “We’re happy to record document revenues and progressed adjusted EBITDA for MariMed. I proceed to imagine we personal probably the most most powerful portfolios of hashish manufacturers within the trade, which helped us power annual wholesale profit enlargement of 29 p.c. Our manufacturers proceed to achieve marketplace proportion in all our core markets, with Betty’s Eddies fruit chews lately the top-selling suitable for eating in Massachusetts and Maryland.

“Having a look forward to 2025, now we have quite a few levers to gasoline our enlargement, together with: a complete yr of economic contribution after finishing the build-out or growth of 10 revenue-generating belongings over the last two years; persevered wholesale beneficial properties in Illinois, Missouri, and Maryland; the consolidation of Delaware’s First State Compassion Middle into MariMed because the state prepares for adult-use gross sales; and accretive M&A process that can improve expanded marketplace penetration for our manufacturers in new and current states.”

MariMed Leader Monetary Officer Mario Pinho stated, “MariMed continues to deal with one in every of the most powerful stability sheets within the hashish trade, and we’re happy to record that we effectively accomplished our revised 2024 monetary steering for profit enlargement and altered EBITDA. Having a look forward, we’re well-positioned to leverage our manufacturers and skill to power persevered top-line enlargement and extra give a boost to profitability in 2025. As we navigate the evolving trade panorama, we stay enthusiastic about executing our process of handing over the most productive manufacturers to our consumers and handing over long-term price to our shareholders.”

Monetary Highlights1

The following desk summarizes the corporate’s consolidated monetary highlights (in thousands and thousands, apart from proportion quantities):

1 See the reconciliations of non-GAAP monetary measures to essentially the most at once similar GAAP measures and extra details about non-GAAP measures within the segment entitled “Dialogue of Non-GAAP Monetary Measures” beneath and within the financials data incorporated herewith.

Fourth Quarter 2024 Operational Highlights

All over the fourth quarter, the corporate introduced the next tendencies within the implementation of its strategic enlargement plan:

- Oct. 14: Commenced rising operations in its new cultivation facility in Mt. Vernon, Sick. The new facility lets in the corporate to develop its award-winning, high quality Nature’s Heritage flower for distribution right through the state. The corporate expects the primary harvest to be on cabinets this month.

- Oct. 30: Introduced the graduation of producing operations in Missouri. The corporate started wholesale distribution of its branded merchandise right through the state in overdue December 2024.

Different Trends

Next to the tip of the fourth quarter, the corporate introduced the next construction:

- March 3: The state of Delaware authorized the corporate as the landlord of First State Compassion Middle (FSCC), the state’s main vertical hashish operator. Previous to the consolidation of FSCC’s cultivation and processing amenities and two dispensaries into MariMed, the corporate have been offering control services and products to FSCC since 2014.

Dialogue of non-GAAP Monetary Measures

MariMed’s control makes use of a number of other monetary measures, each GAAP and non-GAAP, in examining and assessing the total efficiency of its trade, making running selections, and making plans and forecasting long run sessions. The corporate has supplied on this unencumber a number of non-GAAP monetary measures: Non-GAAP Gross margin, Non-GAAP Internet source of revenue (loss), Non-GAAP Adjusted EBITDA and non-GAAP Adjusted EBITDA margin, as dietary supplements to Earnings, Gross margin, Internet (loss) source of revenue and different monetary measures ready in line with GAAP.

Control believes those non-GAAP monetary measures are helpful in reviewing and assessing the efficiency of the corporate, and when making plans and forecasting long run sessions, as they supply significant running effects by way of aside from the results of bills that don’t seem to be reflective of its running trade efficiency. As well as, the corporate’s control makes use of those non-GAAP monetary measures to know and evaluate running effects throughout accounting sessions and for monetary and operational decision-making. The presentation of those non-GAAP measures isn’t meant to be regarded as in isolation or as an alternative choice to the monetary data ready in accordance with GAAP.

Control believes that buyers and analysts take pleasure in making an allowance for non-GAAP monetary measures in assessing the corporate’s monetary effects and its ongoing trade, because it lets in for significant comparisons and research of traits within the trade. Specifically, non-GAAP adjusted EBITDA is utilized by many buyers and analysts themselves, along side different metrics, to check monetary effects throughout accounting sessions and to these of peer corporations.

As there aren’t any standardized strategies of calculating non-GAAP monetary measures, the corporate’s calculations would possibly range from the ones utilized by analysts, buyers and different corporations, even the ones inside the hashish trade, and subsequently would possibly now not be at once similar to in a similar fashion titled measures utilized by others.

Control defines non-GAAP Adjusted EBITDA as source of revenue from operations, made up our minds in accordance with GAAP, aside from the next pieces:

- depreciation of mounted belongings;

- amortization of bought intangible belongings;

- Impairment or write-downs of intangible belongings;

- stock revaluation;

- stock-based reimbursement;

- severance;

- criminal settlements; and

- acquisition-related and different bills.

For additional data, please seek advice from the publicly to be had monetary filings to be had on MariMed’s Investor Members of the family web site, as filed with the U.S. Securities and Alternate Fee, or as filed with the Canadian securities regulatory government at the SEDAR web site.