[PRESS RELEASE] – STAMFORD, Conn., Would possibly 8, 2025 – Curaleaf Holdings Inc., a number one global supplier of client merchandise in hashish, reported its monetary and running effects for the primary quarter ended March 31, 2025. All monetary data is reported according to U.S. most often authorised accounting rules (GAAP) and is supplied in U.S. bucks, until in a different way indicated.

“First quarter earnings was once $310 million, with an adjusted gross benefit of $155 million, leading to a 50% adjusted gross margin, an building up of 250 foundation issues in comparison to the prior yr length” Curaleaf Chairman and CEO Boris Jordan mentioned. “We ended Q1 with $122 million in money, with running and loose money waft from proceeding operations of $42 million and $26 million, respectively. Moreover, we paid down $20 million in acquisition-related debt.

“World earnings grew by way of 74% yr–over-year—marking the fourth consecutive quarter of 70% plus expansion—and we’re inspired by way of possibilities for brand new marketplace openings that might materialize over the following yr. I am glad to file that we have now finished a lot of the heavy lifting had to reposition the trade for long-term luck, together with streamlining operations, making improvements to key production metrics, and sprucing our focal point on flower high quality. This was once obtrusive via a number of fresh a hit nationwide product launches, together with our hemp THC power drink, Make a choice FormulaX, our new innovation within the vape class, Make a choice ACE, and the release of our new pre-roll logo, Anthem. I stay sure that we are positioning the trade to stay resilient and agile in a dynamic surroundings.”

First Quarter 2025 Monetary Highlights

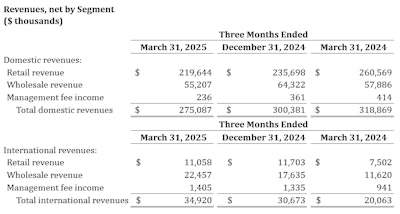

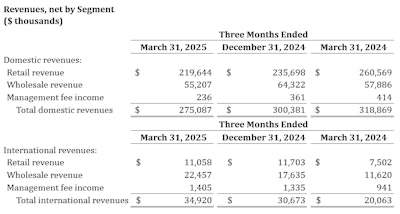

- Web earnings of $310 million, a year-over-year lower of 9% in comparison to Q1 2024 earnings of $338.9 million. Sequentially, web earnings diminished 6% in comparison to This fall 2024 earnings of $331.1 million

- Gross benefit of $155.2 million and gross margin of fifty%, an building up of 260 foundation issues year-over-year

- Adjusted gross benefit(1) of $155.4 million and altered gross margin(1) of fifty%, an building up of 250 foundation issues year-over-year

- Web loss as a consequence of Curaleaf Holdings Inc. from proceeding operations of $54.8 million or web loss in step with percentage from proceeding operations of $0.07

- Adjusted EBITDA(1) of $65.2 million and altered EBITDA margin(1) of 21%, a 180-basis-point lower year-over-year

- Money at quarter finish totaled $121.9 million

First Quarter 2025 Operational Highlights

- Introduced Reef, a high quality flower logo in Florida

- Relocated one retailer in Sedona, Ariz., finishing the quarter with a complete of 149 retail places

- Expanded Make a choice 0 Evidence Hemp Seltzer line with release of two.5-milligram dose possibility and new flavors

- Started promoting Make a choice hemp-derived THC drinks to over 100 Overall Wine shops around the U.S.

- Introduced Make a choice FormulaX, a brand new line of hemp THC power beverages with the added spice up of caffeine

Submit First Quarter 2025 Operational Highlights

- Opened the corporate’s 66th retail location in Florida in Iciness Park, bringing the national retailer rely to 151 places

- Opened the primary absolutely devoted hemp retail storefront in West Palm Seashore, Fla.

- Introduced Anthem, our new pre-roll logo rooted in American innovation, in New York, New Jersey, Illinois, Massachusetts, Arizona and Florida, with extra states to return

- Introduced Make a choice ACE using an unique proprietary Aqueous Hashish Extraction manufacturing manner in New York, Massachusetts and Florida

| (1) | Adjusted EBITDA, adjusted web source of revenue (loss), adjusted gross benefit and loose money waft are non-GAAP monetary measures, and altered EBITDA margin, adjusted web source of revenue (loss) in step with percentage and altered gross margin are non-GAAP monetary ratios, in every case and not using a standardized definition below GAAP and which might not be related to identical measures utilized by different issuers. See “Non-GAAP Monetary Efficiency Measures” beneath for definitions and additional info relating to Curaleaf’s use of non-GAAP monetary measures and non-GAAP monetary ratios. See “Reconciliation of Non-GAAP monetary measures” beneath for a reconciliation of every non-GAAP monetary measure used on this press unlock from essentially the most at once related GAAP monetary measure. |

Stability Sheet and Money Float

As of March 31, 2025, the corporate had $121.9 million of money and $561.2 million of remarkable debt web of unamortized debt reductions.

All over the 3 months ended March 31, 2025, Curaleaf invested $16.3 million in capital expenditures, taken with facility upgrades, automation, and selective retail enlargement in strategic markets.

Stocks Exceptional

For the primary quarter of 2025 and 2024, the corporate’s weighted reasonable subordinate vote casting stocks plus more than one vote casting stocks remarkable amounted to 744,898,937 and 736,147,618 stocks, respectively.

Non-GAAP Monetary and Efficiency Measures

Curaleaf studies its monetary leads to accordance with GAAP and makes use of numerous monetary measures and ratios when assessing its effects and measuring general efficiency. A few of these monetary measures and ratios aren’t calculated according to GAAP. Curaleaf refers to sure non-GAAP monetary measures and ratios, reminiscent of “adjusted gross benefit”, “adjusted gross margin”, “adjusted web source of revenue (loss)”, “adjusted EBITDA”, “adjusted EBITDA margin” and “Unfastened money waft from operations”. Those measures should not have any standardized which means prescribed by way of GAAP and might not be related to identical measures introduced by way of different issuers. “Adjusted gross benefit” is outlined by way of Curaleaf as gross benefit web of price of products bought and linked different add-backs. “Adjusted gross margin” is outlined by way of Curaleaf as adjusted gross benefit divided by way of general revenues. “Adjusted web source of revenue (loss)” is outlined by way of Curaleaf as web source of revenue (loss) web of (acquire) loss on impairments and linked different add-backs. “Adjusted web source of revenue (loss) in step with percentage” is outlined by way of Curaleaf as adjusted web source of revenue (loss) divided by way of the weighted reasonable not unusual stocks remarkable. “Adjusted EBITDA” is outlined by way of Curaleaf as profits ahead of hobby, taxes, depreciation and amortization much less share-based reimbursement expense and different add-backs associated with trade construction, acquisition, financing and reorganization prices. “Adjusted EBITDA margin” is outlined by way of Curaleaf as adjusted EBITDA divided by way of general earnings. “Unfastened money waft from operations” is outlined by way of Curaleaf as web money supplied by way of running actions from proceeding operations much less the purchases of assets, plant and kit (i.e. web capital expenditures). Curaleaf considers those measures to be a very powerful indicator of the monetary power and function of our trade. Curaleaf believes the adjusted effects introduced supply related and helpful data for traders, as a result of they explain our exact running efficiency, enable you to examine our effects with the ones of different firms and make allowance traders to study efficiency in the similar approach as our control. Since those measures aren’t calculated according to GAAP, they must now not be thought to be in isolation of, or as an alternative choice to, our reported GAAP monetary effects as signs of our efficiency, and so they might not be related to in a similar fashion named measures from different firms. The tables beneath supply reconciliations of Non-GAAP measures to essentially the most at once related GAAP measures.

[PRESS RELEASE] – STAMFORD, Conn., Would possibly 8, 2025 – Curaleaf Holdings Inc., a number one global supplier of client merchandise in hashish, reported its monetary and running effects for the primary quarter ended March 31, 2025. All monetary data is reported according to U.S. most often authorised accounting rules (GAAP) and is supplied in U.S. bucks, until in a different way indicated.

“First quarter earnings was once $310 million, with an adjusted gross benefit of $155 million, leading to a 50% adjusted gross margin, an building up of 250 foundation issues in comparison to the prior yr length” Curaleaf Chairman and CEO Boris Jordan mentioned. “We ended Q1 with $122 million in money, with running and loose money waft from proceeding operations of $42 million and $26 million, respectively. Moreover, we paid down $20 million in acquisition-related debt.

“World earnings grew by way of 74% yr–over-year—marking the fourth consecutive quarter of 70% plus expansion—and we’re inspired by way of possibilities for brand new marketplace openings that might materialize over the following yr. I am glad to file that we have now finished a lot of the heavy lifting had to reposition the trade for long-term luck, together with streamlining operations, making improvements to key production metrics, and sprucing our focal point on flower high quality. This was once obtrusive via a number of fresh a hit nationwide product launches, together with our hemp THC power drink, Make a choice FormulaX, our new innovation within the vape class, Make a choice ACE, and the release of our new pre-roll logo, Anthem. I stay sure that we are positioning the trade to stay resilient and agile in a dynamic surroundings.”

First Quarter 2025 Monetary Highlights

- Web earnings of $310 million, a year-over-year lower of 9% in comparison to Q1 2024 earnings of $338.9 million. Sequentially, web earnings diminished 6% in comparison to This fall 2024 earnings of $331.1 million

- Gross benefit of $155.2 million and gross margin of fifty%, an building up of 260 foundation issues year-over-year

- Adjusted gross benefit(1) of $155.4 million and altered gross margin(1) of fifty%, an building up of 250 foundation issues year-over-year

- Web loss as a consequence of Curaleaf Holdings Inc. from proceeding operations of $54.8 million or web loss in step with percentage from proceeding operations of $0.07

- Adjusted EBITDA(1) of $65.2 million and altered EBITDA margin(1) of 21%, a 180-basis-point lower year-over-year

- Money at quarter finish totaled $121.9 million

First Quarter 2025 Operational Highlights

- Introduced Reef, a high quality flower logo in Florida

- Relocated one retailer in Sedona, Ariz., finishing the quarter with a complete of 149 retail places

- Expanded Make a choice 0 Evidence Hemp Seltzer line with release of two.5-milligram dose possibility and new flavors

- Started promoting Make a choice hemp-derived THC drinks to over 100 Overall Wine shops around the U.S.

- Introduced Make a choice FormulaX, a brand new line of hemp THC power beverages with the added spice up of caffeine

Submit First Quarter 2025 Operational Highlights

- Opened the corporate’s 66th retail location in Florida in Iciness Park, bringing the national retailer rely to 151 places

- Opened the primary absolutely devoted hemp retail storefront in West Palm Seashore, Fla.

- Introduced Anthem, our new pre-roll logo rooted in American innovation, in New York, New Jersey, Illinois, Massachusetts, Arizona and Florida, with extra states to return

- Introduced Make a choice ACE using an unique proprietary Aqueous Hashish Extraction manufacturing manner in New York, Massachusetts and Florida

| (1) | Adjusted EBITDA, adjusted web source of revenue (loss), adjusted gross benefit and loose money waft are non-GAAP monetary measures, and altered EBITDA margin, adjusted web source of revenue (loss) in step with percentage and altered gross margin are non-GAAP monetary ratios, in every case and not using a standardized definition below GAAP and which might not be related to identical measures utilized by different issuers. See “Non-GAAP Monetary Efficiency Measures” beneath for definitions and additional info relating to Curaleaf’s use of non-GAAP monetary measures and non-GAAP monetary ratios. See “Reconciliation of Non-GAAP monetary measures” beneath for a reconciliation of every non-GAAP monetary measure used on this press unlock from essentially the most at once related GAAP monetary measure. |

Stability Sheet and Money Float

As of March 31, 2025, the corporate had $121.9 million of money and $561.2 million of remarkable debt web of unamortized debt reductions.

All over the 3 months ended March 31, 2025, Curaleaf invested $16.3 million in capital expenditures, taken with facility upgrades, automation, and selective retail enlargement in strategic markets.

Stocks Exceptional

For the primary quarter of 2025 and 2024, the corporate’s weighted reasonable subordinate vote casting stocks plus more than one vote casting stocks remarkable amounted to 744,898,937 and 736,147,618 stocks, respectively.

Non-GAAP Monetary and Efficiency Measures

Curaleaf studies its monetary leads to accordance with GAAP and makes use of numerous monetary measures and ratios when assessing its effects and measuring general efficiency. A few of these monetary measures and ratios aren’t calculated according to GAAP. Curaleaf refers to sure non-GAAP monetary measures and ratios, reminiscent of “adjusted gross benefit”, “adjusted gross margin”, “adjusted web source of revenue (loss)”, “adjusted EBITDA”, “adjusted EBITDA margin” and “Unfastened money waft from operations”. Those measures should not have any standardized which means prescribed by way of GAAP and might not be related to identical measures introduced by way of different issuers. “Adjusted gross benefit” is outlined by way of Curaleaf as gross benefit web of price of products bought and linked different add-backs. “Adjusted gross margin” is outlined by way of Curaleaf as adjusted gross benefit divided by way of general revenues. “Adjusted web source of revenue (loss)” is outlined by way of Curaleaf as web source of revenue (loss) web of (acquire) loss on impairments and linked different add-backs. “Adjusted web source of revenue (loss) in step with percentage” is outlined by way of Curaleaf as adjusted web source of revenue (loss) divided by way of the weighted reasonable not unusual stocks remarkable. “Adjusted EBITDA” is outlined by way of Curaleaf as profits ahead of hobby, taxes, depreciation and amortization much less share-based reimbursement expense and different add-backs associated with trade construction, acquisition, financing and reorganization prices. “Adjusted EBITDA margin” is outlined by way of Curaleaf as adjusted EBITDA divided by way of general earnings. “Unfastened money waft from operations” is outlined by way of Curaleaf as web money supplied by way of running actions from proceeding operations much less the purchases of assets, plant and kit (i.e. web capital expenditures). Curaleaf considers those measures to be a very powerful indicator of the monetary power and function of our trade. Curaleaf believes the adjusted effects introduced supply related and helpful data for traders, as a result of they explain our exact running efficiency, enable you to examine our effects with the ones of different firms and make allowance traders to study efficiency in the similar approach as our control. Since those measures aren’t calculated according to GAAP, they must now not be thought to be in isolation of, or as an alternative choice to, our reported GAAP monetary effects as signs of our efficiency, and so they might not be related to in a similar fashion named measures from different firms. The tables beneath supply reconciliations of Non-GAAP measures to essentially the most at once related GAAP measures.