[PRESS RELEASE] – MIAMI, March 6, 2025 – PRESS RELEASE – AYR Wellness Inc., a main vertically built-in U.S. multistate hashish operator, is reporting monetary effects for the fourth quarter and entire yr ended Dec. 31, 2024. Except another way famous, all effects are offered in U.S. bucks.

AYR meantime CEO Steven M. Cohen mentioned, “During the last quarter we’ve made an important steps in opposition to reorienting the trade to mirror our forward-looking imaginative and prescient of AYR. And whilst our fourth quarter and full-year effects mirrored ongoing macroeconomic pressures and company-specific demanding situations that impacted income and profitability, we stay assured that sustained expansion and enhanced profitability are achievable inside our footprint thru disciplined value discounts, streamlined operations, and stepped forward execution.

“To enhance execution, we’ve restructured our management staff through selling George DeNardo to president, whilst Julie Iciness and Jamie Mendola have stepped into the jobs of co-chief income officials. Those adjustments, in conjunction with a broader realignment of our control staff, have already begun to reinforce operational focal point and agility during the group. As we transfer ahead, we stay dedicated to controlling what we can, executing with self-discipline, and positioning AYR for sustainable expansion and profitability.”

DeNardo mentioned, “One among my speedy targets as president is to create higher synergy and collaboration between the income producing and provide chain purposes of our trade. With that during thoughts, our imaginative and prescient for 2025 is all in favour of funding in our core manufacturers and extra streamlining operations to succeed in value efficiencies and facilitate sooner and higher decision-making at each and every degree of our operational infrastructure. As we advance tasks throughout our core markets, we achieve this with a prepared focal point on steadiness sheet self-discipline and making sure the long-term well being and good fortune of AYR.

“We have now already taken key steps to additional streamline our trade, together with getting rid of redundancies and company overhead, refining and construction on our branded product choices, and starting the means of optimizing our state portfolio to concentrate on the important thing markets that may force our trade ahead whilst getting rid of distractions.

“This yr, we also are creating a pivotal funding in our long run with our new cutting-edge indoor cultivation facility in Florida, which permits us to fill a vital hole in our provide chain through offering top of the range indoor flower to our 67 dispensaries around the state. Additional, we plan to make bigger our presence in Ohio in each the retail and wholesale channels and we’re well-positioned for access into the Virginia marketplace.”

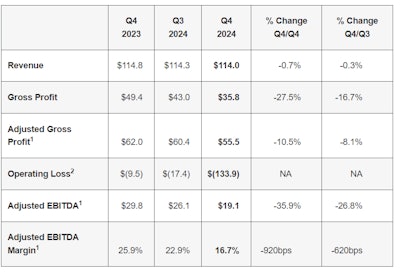

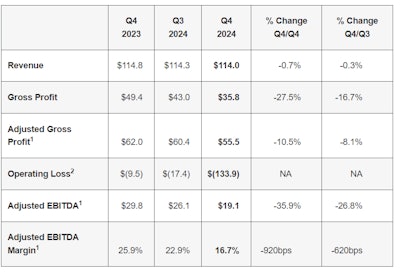

Fourth Quarter Monetary Abstract ($ in tens of millions, excl. margin pieces)

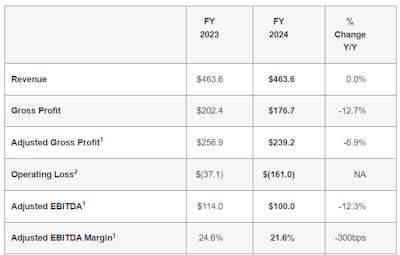

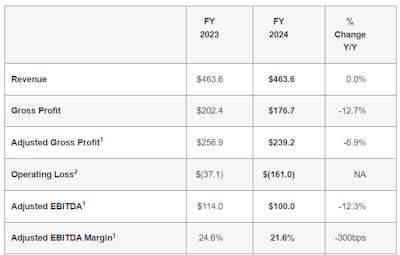

Complete 12 months Monetary Abstract (FY 2023 excludes effects from AZ for all classes) ($ in tens of millions, excl. margin pieces)

1 Adjusted EBITDA, Adjusted Gross Benefit and Adjusted EBITDA Margin are non-GAAP measures, and accordingly aren’t standardized measures and is probably not related to an identical measures utilized by different firms. See Definition and Reconciliation of Non-GAAP Measures under. For a reconciliation of Working Loss to Adjusted EBITDA in addition to Gross Benefit to Adjusted Gross Benefit, see the reconciliation tables appended to this liberate.

2 Contains $118.1M of non-cash impairment fees together with $94 million associated with Florida goodwill impairment fee in the fourth quarter of 2024, in response to marketplace prerequisites on the time.

Fourth Quarter and Fresh Highlights

- Retail/Logo Updates

- Opened new dispensaries in Florida and Ohio, AYR’s 67th in Florida and fourth in Ohio. AYR’s new Miami, Fla., retailer is the primary inside Miami town limits.

- Introduced Later Days Fruit-Flavored Vape Assortment.

- Fresh Management Adjustments

- In January, George DeNardo, AYR’s prior leader working officer, assumed the position of president, accountable for the oversight of all company-wide operations, together with retail, wholesale, buying, advertising, cultivation, and production.

- In February, Brad Asher, AYR’s leader monetary officer, equipped understand of resignation to the corporate in reference to the pursuit of every other alternative. Asher’s resignation will likely be efficient at a mutually agreed-upon date following the corporate’s submitting of 2024 annual monetary statements.

- The corporate introduced the resignation of Jared Cohen from its board of administrators and transition to board observer.

- The board continues to seek for an everlasting CEO and has retained True Seek, an international recruiting company, to steer the hunt.

Complete 12 months 2024 Highlights

- Opened 11 dispensaries throughout AYR’s footprint, bringing the corporate’s overall dispensary rely to 97 retail outlets. This integrated growth into Connecticut, AYR’s 8th marketplace with retail publicity.

- Participated within the adult-use release in Ohio with 4 retail retail outlets and cultivation and manufacturing belongings.

- Won conditional license approval to open vertically built-in operations in Virginia.

- In November 2024, the New York Hashish Keep watch over Board voted to approve the utility for Amethyst Well being LLC for registration as a “registered group,” which might conditionally permit Amethyst Well being to begin clinical marijuana operations within the state. AYR is an operational spouse and minority fairness holder in Amethyst Well being.

- Secured actual property financing for indoor cultivation in Florida, with plans to redevelop a 98,000-square-foot construction inside the belongings to function a regulated hashish cultivation facility. The financing used to be finished with Cutting edge Business Houses (IIP); IIP dedicated to investment AYR as much as $30 million for the development. Construction of the power is underway with plans for contributions in the second one part of 2025.

- In February 2024, the corporate finished the retirement or deferral of the adulthood of all 2024 senior notes and likely different debt totaling just about $400 million through two years to 2026.

- Raised roughly $40 million of gross proceeds in new capital during the issuance of $50 million of extra senior notes maturing in December 2026.

Capital Construction and Liquidity

The corporate deployed $1.2 million of capital expenditures in This fall and roughly $17.7 million for FY 2024, which used to be much less than the corporate’s steerage of $20 million for the overall yr and down from $28 million in FY 2023. For FY 2025, the corporate expects capital expenditure to be roughly $10 million.

The corporate ended the yr with a coins steadiness of $35.5 million, down from $50.6 million on the finish of Q3 and $50.8 million at the top of FY 2023. Next to year-end, the corporate gained $4 million in proceeds from the sale of ERC tax credit. For FY 2024, AYR generated $9.6 million of money float from operations.

As of year-end 2024, the corporate had roughly 116.8 million absolutely diluted stocks remarkable in response to a treasury manner calculation (aside from 23 million out-of-the-money warrants exercisable at $2.12 and expiring in February 2026) and a pair of.9 million limited inventory gadgets.

Outlook

For the primary quarter of 2025, the corporate expects income to be down mid-single digits in comparison to This fall 2024, with a modest building up in adjusted EBITDA margin.

[PRESS RELEASE] – MIAMI, March 6, 2025 – PRESS RELEASE – AYR Wellness Inc., a main vertically built-in U.S. multistate hashish operator, is reporting monetary effects for the fourth quarter and entire yr ended Dec. 31, 2024. Except another way famous, all effects are offered in U.S. bucks.

AYR meantime CEO Steven M. Cohen mentioned, “During the last quarter we’ve made an important steps in opposition to reorienting the trade to mirror our forward-looking imaginative and prescient of AYR. And whilst our fourth quarter and full-year effects mirrored ongoing macroeconomic pressures and company-specific demanding situations that impacted income and profitability, we stay assured that sustained expansion and enhanced profitability are achievable inside our footprint thru disciplined value discounts, streamlined operations, and stepped forward execution.

“To enhance execution, we’ve restructured our management staff through selling George DeNardo to president, whilst Julie Iciness and Jamie Mendola have stepped into the jobs of co-chief income officials. Those adjustments, in conjunction with a broader realignment of our control staff, have already begun to reinforce operational focal point and agility during the group. As we transfer ahead, we stay dedicated to controlling what we can, executing with self-discipline, and positioning AYR for sustainable expansion and profitability.”

DeNardo mentioned, “One among my speedy targets as president is to create higher synergy and collaboration between the income producing and provide chain purposes of our trade. With that during thoughts, our imaginative and prescient for 2025 is all in favour of funding in our core manufacturers and extra streamlining operations to succeed in value efficiencies and facilitate sooner and higher decision-making at each and every degree of our operational infrastructure. As we advance tasks throughout our core markets, we achieve this with a prepared focal point on steadiness sheet self-discipline and making sure the long-term well being and good fortune of AYR.

“We have now already taken key steps to additional streamline our trade, together with getting rid of redundancies and company overhead, refining and construction on our branded product choices, and starting the means of optimizing our state portfolio to concentrate on the important thing markets that may force our trade ahead whilst getting rid of distractions.

“This yr, we also are creating a pivotal funding in our long run with our new cutting-edge indoor cultivation facility in Florida, which permits us to fill a vital hole in our provide chain through offering top of the range indoor flower to our 67 dispensaries around the state. Additional, we plan to make bigger our presence in Ohio in each the retail and wholesale channels and we’re well-positioned for access into the Virginia marketplace.”

Fourth Quarter Monetary Abstract ($ in tens of millions, excl. margin pieces)

Complete 12 months Monetary Abstract (FY 2023 excludes effects from AZ for all classes) ($ in tens of millions, excl. margin pieces)

1 Adjusted EBITDA, Adjusted Gross Benefit and Adjusted EBITDA Margin are non-GAAP measures, and accordingly aren’t standardized measures and is probably not related to an identical measures utilized by different firms. See Definition and Reconciliation of Non-GAAP Measures under. For a reconciliation of Working Loss to Adjusted EBITDA in addition to Gross Benefit to Adjusted Gross Benefit, see the reconciliation tables appended to this liberate.

2 Contains $118.1M of non-cash impairment fees together with $94 million associated with Florida goodwill impairment fee in the fourth quarter of 2024, in response to marketplace prerequisites on the time.

Fourth Quarter and Fresh Highlights

- Retail/Logo Updates

- Opened new dispensaries in Florida and Ohio, AYR’s 67th in Florida and fourth in Ohio. AYR’s new Miami, Fla., retailer is the primary inside Miami town limits.

- Introduced Later Days Fruit-Flavored Vape Assortment.

- Fresh Management Adjustments

- In January, George DeNardo, AYR’s prior leader working officer, assumed the position of president, accountable for the oversight of all company-wide operations, together with retail, wholesale, buying, advertising, cultivation, and production.

- In February, Brad Asher, AYR’s leader monetary officer, equipped understand of resignation to the corporate in reference to the pursuit of every other alternative. Asher’s resignation will likely be efficient at a mutually agreed-upon date following the corporate’s submitting of 2024 annual monetary statements.

- The corporate introduced the resignation of Jared Cohen from its board of administrators and transition to board observer.

- The board continues to seek for an everlasting CEO and has retained True Seek, an international recruiting company, to steer the hunt.

Complete 12 months 2024 Highlights

- Opened 11 dispensaries throughout AYR’s footprint, bringing the corporate’s overall dispensary rely to 97 retail outlets. This integrated growth into Connecticut, AYR’s 8th marketplace with retail publicity.

- Participated within the adult-use release in Ohio with 4 retail retail outlets and cultivation and manufacturing belongings.

- Won conditional license approval to open vertically built-in operations in Virginia.

- In November 2024, the New York Hashish Keep watch over Board voted to approve the utility for Amethyst Well being LLC for registration as a “registered group,” which might conditionally permit Amethyst Well being to begin clinical marijuana operations within the state. AYR is an operational spouse and minority fairness holder in Amethyst Well being.

- Secured actual property financing for indoor cultivation in Florida, with plans to redevelop a 98,000-square-foot construction inside the belongings to function a regulated hashish cultivation facility. The financing used to be finished with Cutting edge Business Houses (IIP); IIP dedicated to investment AYR as much as $30 million for the development. Construction of the power is underway with plans for contributions in the second one part of 2025.

- In February 2024, the corporate finished the retirement or deferral of the adulthood of all 2024 senior notes and likely different debt totaling just about $400 million through two years to 2026.

- Raised roughly $40 million of gross proceeds in new capital during the issuance of $50 million of extra senior notes maturing in December 2026.

Capital Construction and Liquidity

The corporate deployed $1.2 million of capital expenditures in This fall and roughly $17.7 million for FY 2024, which used to be much less than the corporate’s steerage of $20 million for the overall yr and down from $28 million in FY 2023. For FY 2025, the corporate expects capital expenditure to be roughly $10 million.

The corporate ended the yr with a coins steadiness of $35.5 million, down from $50.6 million on the finish of Q3 and $50.8 million at the top of FY 2023. Next to year-end, the corporate gained $4 million in proceeds from the sale of ERC tax credit. For FY 2024, AYR generated $9.6 million of money float from operations.

As of year-end 2024, the corporate had roughly 116.8 million absolutely diluted stocks remarkable in response to a treasury manner calculation (aside from 23 million out-of-the-money warrants exercisable at $2.12 and expiring in February 2026) and a pair of.9 million limited inventory gadgets.

Outlook

For the primary quarter of 2025, the corporate expects income to be down mid-single digits in comparison to This fall 2024, with a modest building up in adjusted EBITDA margin.