California lawmakers didn’t act briefly sufficient to halt the state’s hashish excise tax fee from expanding to 19% on July 1, however trade stakeholders celebrated a better-late-than-never victory on Sept. 10.

The California Senate voted, 39-1, on Wednesday to approve an Meeting-passed invoice that can roll again the rise to fifteen% beginning on Oct. 1 and droop the excise tax from going up once more till no less than June 30, 2028.

The have an effect on of this coverage shift is a game-changer for lots of the state’s hashish outlets.

In 2024, there have been more or less 1,200 authorized dispensaries that reported $4.9 billion in taxable gross sales, in step with the California Division of Tax and Charge Management (CDTFA). For the typical dispensary, the variation between a fifteen% and 19% excise tax is greater than $100,000 according to 12 months.

The Meeting handed the regulation, Meeting Invoice 564, in a 74-0 vote in early June. The chamber concurred with the Senate amendments on September 11, which means it’s now being ready for Gov. Gavin Newsom’s attention.

Pushing the regulation around the end line comes after Rep. Matt Haney, D-San Francisco, first offered A.B. 564 in early February.

When Sen. Christopher Cabaldon, D-Yolo, offered the regulation at the Senate ground this week, he identified that California’s regulated hashish marketplace is still dwarfed by way of the unlicensed marketplace just about 9 years after California citizens legalized grownup use thru approving Proposition 64 within the 2016 election.

In passing Prop. 64, citizens sought after 3 issues, Cabaldon mentioned:

- To make hashish legally to be had and protected

- To close down the illicit market

- To reinforce all kinds of environmental, social and academic methods

“That deal is fraying for the reason that marketplace is collapsing,” he mentioned. “And, as of late, felony companies in California seize simply 40% of the hashish marketplace. Sixty p.c is within the illicit marketplace, topic to no protections for customers or for the surroundings. And California is shedding flooring.”

Cabaldon used to be referencing a California Division of Hashish Keep watch over (DCC)-commissioned record that used to be launched to state lawmakers in March. ERA Economics LLC ready the record, which estimated that 38% of hashish ate up in California in 2024 got here from the authorized market, whilst the opposite 62% got here from unregulated and untaxed assets.

Additionally, ERA Economics estimated that unlicensed cultivators produced 11.4 million kilos of hashish, or more or less 8 instances greater than the 1.4 million kilos produced by way of authorized cultivators. An estimated 9 million kilos left the state.

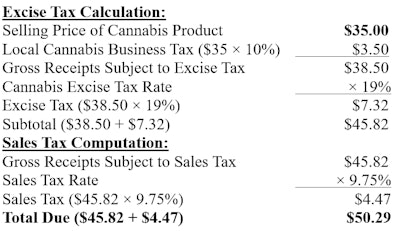

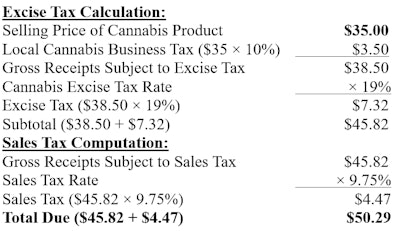

Whilst California’s authorized dispensaries be offering one of the most cost-effective hashish costs within the country, it’s additionally probably the most heaviest taxed markets within the U.S., with the promoting value of a product steadily marked up up to 44% at retail after computing native hashish industry taxes, the excise tax, and the state sales-and-use tax.

Right here’s an instance of ways a $35 hashish product in Los Angeles is lately taxed at a cumulative 43.7% fee for a last $50.29 transaction:

Whilst some would possibly assume that upper taxes result in extra tax earnings, that’s now not all the time the case.

If $4.9 billion in taxable gross sales represents 38% of the marketplace, then California is lacking out on taxing $8 billion in unlicensed gross sales. That mentioned, if California’s authorized program had been in a position to seize 80% of the marketplace, the state may just reduce the excise tax in part, to 7.5%, and it could nonetheless gather extra earnings than it does now on the 15% fee.

Sens. Jerry McNerney, D-Pleasanton, and Tony Strickland, R-Huntington Seashore, expressed this point of view throughout the Senate’s Sept. 10 ground consultation.

“The nonprofits are relying in this tax earnings [and] are in reality desiring assist,” McNerney mentioned. “However even the larger image is that we wish to keep watch over and include and cut back the unlawful marketplace. Elevating taxes presently goes to have an reverse impact. It’s going to force other people into the unlawful black marketplace on hashish, which is a foul result.”

Strickland mentioned, “I’m happy that my colleagues perceive whilst you elevate taxes, it’s dangerous for industry. I keep in mind that now you keep in mind that whilst you elevate taxes, it’s now not excellent for the people who find themselves in reality offering the product. So, I am hoping you take into accout now not simply hashish, however different problems we speak about, that whilst you decrease the tax burden, it in reality is excellent for industry and the economic system of California.”

Particularly, the hashish excise tax build up to 19% used to be a cause that used to be installed position beneath a regulation, A.B. 195, that Newsom orchestrated in 2022 as a trailer to the state price range he signed that June. The regulation used to be the results of a compromise he struck with sure hashish tax earnings beneficiaries to make up for California’s removal of a $161-per-pound cultivation tax.

The Allocation 3 recipients of California’s hashish tax revenues come with dozens of organizations, from childcare methods and early life teams to environmental, natural world and conservation methods, regulation enforcement and justice organizations, and drug remedy prevention facilities.

Many representatives from the tax beneficiary organizations adversarial A.B. 564 throughout committee hearings, arguing that holding the excise tax at 15% would deprive them of an important investment.

In the meantime, supporters of A.B. 564 argue that the ones Tier 3 organizations will have to be funded throughout the state price range and now not tied to the successes or struggles of the hashish trade.

Beneath A.B. 564, the DCC could be required to visit the CDTFA and the Legislative Analyst’s Place of job and put up a report back to the Legislature by way of Oct. 1, 2027, that analyzes the have an effect on of the state’s hashish tax regulation at the regulated marketplace. The record should additionally suggest choices for converting the regulation to perform the intent of legalization.

In spite of the Legislature lining itself as much as undergo this procedure once more in two years, trade stakeholders are taking the suspended excise tax build up as a win.

The passage of A.B. 564 “proves that sound coverage wins” when state lawmakers pay attention to “information over rhetoric,” mentioned Amy O’Gorman, the manager director of the California Hashish Operators Affiliation.

“This invoice protects customers from unhealthy illicit merchandise whilst retaining the tax earnings that helps crucial methods like kid care and neighborhood reinvestment,” she mentioned. “Through preventing this faulty tax hike, the Legislature identified that good coverage grows earnings by way of holding the felony marketplace viable. Using customers clear of regulated dispensaries would have simplest undermined public protection and decreased investment for the very methods all of us need to give protection to.”

O’Gorman mentioned A.B. 564’s passage may even save 1000’s of jobs within the country’s biggest hashish marketplace, which employs just about 75,000 employees all the way through the state.

California lawmakers didn’t act briefly sufficient to halt the state’s hashish excise tax fee from expanding to 19% on July 1, however trade stakeholders celebrated a better-late-than-never victory on Sept. 10.

The California Senate voted, 39-1, on Wednesday to approve an Meeting-passed invoice that can roll again the rise to fifteen% beginning on Oct. 1 and droop the excise tax from going up once more till no less than June 30, 2028.

The have an effect on of this coverage shift is a game-changer for lots of the state’s hashish outlets.

In 2024, there have been more or less 1,200 authorized dispensaries that reported $4.9 billion in taxable gross sales, in step with the California Division of Tax and Charge Management (CDTFA). For the typical dispensary, the variation between a fifteen% and 19% excise tax is greater than $100,000 according to 12 months.

The Meeting handed the regulation, Meeting Invoice 564, in a 74-0 vote in early June. The chamber concurred with the Senate amendments on September 11, which means it’s now being ready for Gov. Gavin Newsom’s attention.

Pushing the regulation around the end line comes after Rep. Matt Haney, D-San Francisco, first offered A.B. 564 in early February.

When Sen. Christopher Cabaldon, D-Yolo, offered the regulation at the Senate ground this week, he identified that California’s regulated hashish marketplace is still dwarfed by way of the unlicensed marketplace just about 9 years after California citizens legalized grownup use thru approving Proposition 64 within the 2016 election.

In passing Prop. 64, citizens sought after 3 issues, Cabaldon mentioned:

- To make hashish legally to be had and protected

- To close down the illicit market

- To reinforce all kinds of environmental, social and academic methods

“That deal is fraying for the reason that marketplace is collapsing,” he mentioned. “And, as of late, felony companies in California seize simply 40% of the hashish marketplace. Sixty p.c is within the illicit marketplace, topic to no protections for customers or for the surroundings. And California is shedding flooring.”

Cabaldon used to be referencing a California Division of Hashish Keep watch over (DCC)-commissioned record that used to be launched to state lawmakers in March. ERA Economics LLC ready the record, which estimated that 38% of hashish ate up in California in 2024 got here from the authorized market, whilst the opposite 62% got here from unregulated and untaxed assets.

Additionally, ERA Economics estimated that unlicensed cultivators produced 11.4 million kilos of hashish, or more or less 8 instances greater than the 1.4 million kilos produced by way of authorized cultivators. An estimated 9 million kilos left the state.

Whilst California’s authorized dispensaries be offering one of the most cost-effective hashish costs within the country, it’s additionally probably the most heaviest taxed markets within the U.S., with the promoting value of a product steadily marked up up to 44% at retail after computing native hashish industry taxes, the excise tax, and the state sales-and-use tax.

Right here’s an instance of ways a $35 hashish product in Los Angeles is lately taxed at a cumulative 43.7% fee for a last $50.29 transaction:

Whilst some would possibly assume that upper taxes result in extra tax earnings, that’s now not all the time the case.

If $4.9 billion in taxable gross sales represents 38% of the marketplace, then California is lacking out on taxing $8 billion in unlicensed gross sales. That mentioned, if California’s authorized program had been in a position to seize 80% of the marketplace, the state may just reduce the excise tax in part, to 7.5%, and it could nonetheless gather extra earnings than it does now on the 15% fee.

Sens. Jerry McNerney, D-Pleasanton, and Tony Strickland, R-Huntington Seashore, expressed this point of view throughout the Senate’s Sept. 10 ground consultation.

“The nonprofits are relying in this tax earnings [and] are in reality desiring assist,” McNerney mentioned. “However even the larger image is that we wish to keep watch over and include and cut back the unlawful marketplace. Elevating taxes presently goes to have an reverse impact. It’s going to force other people into the unlawful black marketplace on hashish, which is a foul result.”

Strickland mentioned, “I’m happy that my colleagues perceive whilst you elevate taxes, it’s dangerous for industry. I keep in mind that now you keep in mind that whilst you elevate taxes, it’s now not excellent for the people who find themselves in reality offering the product. So, I am hoping you take into accout now not simply hashish, however different problems we speak about, that whilst you decrease the tax burden, it in reality is excellent for industry and the economic system of California.”

Particularly, the hashish excise tax build up to 19% used to be a cause that used to be installed position beneath a regulation, A.B. 195, that Newsom orchestrated in 2022 as a trailer to the state price range he signed that June. The regulation used to be the results of a compromise he struck with sure hashish tax earnings beneficiaries to make up for California’s removal of a $161-per-pound cultivation tax.

The Allocation 3 recipients of California’s hashish tax revenues come with dozens of organizations, from childcare methods and early life teams to environmental, natural world and conservation methods, regulation enforcement and justice organizations, and drug remedy prevention facilities.

Many representatives from the tax beneficiary organizations adversarial A.B. 564 throughout committee hearings, arguing that holding the excise tax at 15% would deprive them of an important investment.

In the meantime, supporters of A.B. 564 argue that the ones Tier 3 organizations will have to be funded throughout the state price range and now not tied to the successes or struggles of the hashish trade.

Beneath A.B. 564, the DCC could be required to visit the CDTFA and the Legislative Analyst’s Place of job and put up a report back to the Legislature by way of Oct. 1, 2027, that analyzes the have an effect on of the state’s hashish tax regulation at the regulated marketplace. The record should additionally suggest choices for converting the regulation to perform the intent of legalization.

In spite of the Legislature lining itself as much as undergo this procedure once more in two years, trade stakeholders are taking the suspended excise tax build up as a win.

The passage of A.B. 564 “proves that sound coverage wins” when state lawmakers pay attention to “information over rhetoric,” mentioned Amy O’Gorman, the manager director of the California Hashish Operators Affiliation.

“This invoice protects customers from unhealthy illicit merchandise whilst retaining the tax earnings that helps crucial methods like kid care and neighborhood reinvestment,” she mentioned. “Through preventing this faulty tax hike, the Legislature identified that good coverage grows earnings by way of holding the felony marketplace viable. Using customers clear of regulated dispensaries would have simplest undermined public protection and decreased investment for the very methods all of us need to give protection to.”

O’Gorman mentioned A.B. 564’s passage may even save 1000’s of jobs within the country’s biggest hashish marketplace, which employs just about 75,000 employees all the way through the state.