[PRESS RELEASE] – NEW YORK, March 13, 2025 – The Cannabist Co. Holdings Inc., one of the crucial skilled cultivators, producers and shops of hashish merchandise within the U.S., reported its monetary and working effects for the fourth quarter and entire yr ended Dec. 31, 2024. All monetary data offered on this unlock is in U.S. usually authorized accounting ideas (GAAP), unaudited, and in 1000’s of U.S. bucks until another way famous.

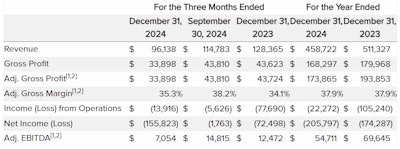

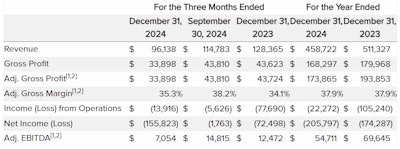

Fourth Quarter & Complete 12 months 2024 Monetary Highlights (in $ 1000’s, excl. margin pieces):

| [1] Denotes a non-GAAP measure. See “Non-GAAP Monetary Measures” on this press unlock for more info in regards to the Corporate’s use of non-GAAP monetary measures, in addition to Desk 4 for reconciliation, the place appropriate. |

| [2] Each Adj. Gross Benefit and Adj. EBITDA excludes $101k in This autumn 2023, $5.6 million for FY 2024 and $13.9 million in FY 2023; see the Corporate’s Annual Record on Shape 10-Ok for the duration ended December 31, 2024, for added disclosure. |

“As we persisted our corporate’s transformation during 2024, we carried out structural adjustments to the trade and done on key tasks to optimize our retail and cultivation belongings, divest non-strategic belongings, root out provide chain inefficiencies, and capitalize on adult-use adoption in Ohio,” The Cannabist Co. CEO David Hart mentioned. “Using a complete option to steadiness sheet control, on February 27, we introduced an settlement to increase the maturities on our senior secured debt till December 2028, with choices to increase via 2029. With lately 70% enhance from our noteholders, we’re assured that this procedure will likely be finished. This transaction supplies runway for us to concentrate on the ongoing optimization of our trade, as we entire divestitures, proceed to scale back working and overhead prices, refine our stock collection, and enhance the operational and fiscal efficiency of the corporate.

“Our mandate in 2025 is to proceed to simplify our trade, care for liquidity, enhance margins, and pressure money go with the flow era, placing us able to prevail. We’ve got significant catalysts in 2025, together with the transition to grownup use in Delaware and the addition of retail places in most sensible markets corresponding to Virginia and Ohio.”

Best 5 Markets by way of Income in This autumn[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

Best 5 Markets by way of Adjusted EBITDA in This autumn[3]: Maryland, New Jersey, New York, Ohio, Virginia

| [3] Markets are indexed alphabetically |

Monetary Highlights for Fourth Quarter and Complete 12 months 2024

- Fourth quarter income of $96.1 million, a lower of 16% from the 3rd quarter, basically on account of the sale of Jap Virginia and Arizona companies in August, in addition to 14 retail outlets in Florida all over This autumn.

- Gross margin within the fourth quarter used to be 35%, down sequentially, however up 120 foundation issues (bps) in comparison to This autumn 2023. For the overall yr 2024, adjusted gross margin remained flat at 38%.

- Adjusted EBITDA in This autumn of $7 million, as when put next with $14.8 million in Q3; sequential contraction used to be in large part pushed by way of the sale of belongings in Virginia and Arizona, which closed all over Q3, in addition to pricing power in numerous key markets.

- For the 12 markets last following the divestiture of Florida and Washington, D.C., gross margin for FY 2024 larger greater than 200 bps yr over yr, and altered EBITDA margin for the overall yr used to be necessarily flat in comparison to 2023 for the ones 12 markets.

- This autumn effects had been impacted by way of a $3.1 million provision for credit score losses and a $2.1 million intangible impairment.

- On Nov. 7, the corporate closed at the sale of all 14 Cannabist dispensaries and two cultivation amenities in Florida for attention of $5 million; transactions for the sale of the remainder Clinical Marijuana Remedy Middle (MMTC) license and one cultivation facility are pending finalization.

- Capital expenditures within the fourth quarter had been $1.7 million; the corporate continues to be expecting capital expenditures to reasonable $2 million to $3 million in keeping with quarter once more in 2025.

- In This autumn 2024, the corporate accomplished a favorable working money go with the flow of $4.3 million.

- The corporate ended the fourth quarter with $33.6 million in money, up from $31.5 million in money on the finish of Q3.

- Via a number of rounds of company restructuring all over 2024, the corporate accomplished $23 million in annualized price financial savings, because of changes to align with a simplified footprint.

- Next to the quarter shut, the corporate introduced an settlement with noteholders to increase the maturities of senior secured notes to December 2028, with choices to increase via 2029.

Operational Highlights for Fourth Quarter and Complete 12 months 2024

- For FY 2024, wholesale income larger 11% over 2023; wholesale accounted for about 15% of overall income in 2024, in comparison to 12% of overall income in 2023 and 14% in 2022.

- Wholesale income diminished 20% sequentially in This autumn, impacted partially by way of asset gross sales in Jap Virginia and Arizona; wholesale represented 16% of overall income in This autumn.

- New York demonstrated the biggest building up in adjusted EBITDA quarter over quarter because the wholesale marketplace stepped forward; New York used to be a Best 5 marketplace in gross margin and altered EBITDA in This autumn.

- On account of the sale of 14 retail places in Florida, the closure of 1 location in Boston, the sale of 1 location in California, the re-opening of 1 location in Colorado, and one new opening in New Jersey all over This autumn, the quarter-end lively retail rely used to be 59, in comparison to 73 lively retail places on the finish of Q3 and 86 at year-end 2023.

- In February 2025, the corporate closed 3 underperforming places in Colorado, bringing the whole lively retail rely to 56 at this time.

- The corporate has further retail places in construction, together with one in Virginia and 3 in Ohio.

Non-GAAP Monetary Measures

On this press unlock, the corporate refers to positive non-GAAP monetary measures, together with Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Benefit and Adjusted Gross Margin. The corporate considers positive non-GAAP measures to be significant signs of the efficiency of its trade. Those measures aren’t identified measures underneath GAAP, wouldn’t have a standardized which means prescribed by way of GAAP and might not be similar to (and could also be calculated otherwise by way of) different corporations that provide equivalent measures. Accordingly, those measures will have to no longer be regarded as in isolation from nor as an alternative choice to our monetary data reported underneath GAAP. Those non-GAAP measures are used to offer traders with supplemental measures of our working efficiency and thus spotlight tendencies in our trade that would possibly not another way be obvious when depending only on GAAP measures. Those supplemental non-GAAP monetary measures will have to no longer be regarded as awesome to, as an alternative choice to, or as a substitute for, and will have to be regarded as along side, the GAAP monetary measures offered. We additionally acknowledge that securities analysts, traders and different events incessantly use non-GAAP measures within the analysis of businesses inside our trade.

With appreciate to non-GAAP monetary measures, the corporate defines EBITDA as web source of revenue (loss) ahead of (i) depreciation and amortization; (ii) source of revenue taxes; and (iii) pastime expense and debt amortization. Adjusted EBITDA is outlined as EBITDA ahead of (i) share-based reimbursement expense; (ii) goodwill and intangible impairment, (iii) changes for acquisition and different non-core prices; (iv) achieve on remeasurement of contingent attention, web, (v) honest worth adjustments on spinoff liabilities; and (vi) honest worth mark-up for got stock. Adjusted EBITDA Margin is outlined as Adjusted EBITDA divided by way of Income. Adjusted Gross Benefit is outlined as gross benefit ahead of the honest mark-up for got stock. Adjusted Gross Margin is outlined as gross margin ahead of the honest mark-up for got stock.

The corporate perspectives those non-GAAP monetary measures as a way to facilitate control’s monetary and operational decision-making, together with analysis of the corporate’s ancient working effects and comparability to competition’ working effects. Those non-GAAP monetary measures mirror an extra method of viewing sides of the corporate’s operations that, when seen with GAAP effects and the reconciliations to the corresponding GAAP monetary measure, would possibly supply a extra entire working out of things and tendencies affecting the corporate’s trade. The resolution of the quantities which are excluded from those non-GAAP monetary measures is an issue of control judgment and depends on, amongst different components, the character of the underlying expense or source of revenue quantities. As a result of non-GAAP monetary measures exclude the impact of things that may building up or lower the corporate’s reported result of operations, control strongly encourages traders to check the corporate’s consolidated monetary statements and publicly filed experiences of their entirety.

Reconciliations of non-GAAP monetary measures to their nearest similar GAAP measures are integrated on this press unlock and an additional dialogue of a few of these pieces is contained in our annual document on Shape 10-Ok.

[PRESS RELEASE] – NEW YORK, March 13, 2025 – The Cannabist Co. Holdings Inc., one of the crucial skilled cultivators, producers and shops of hashish merchandise within the U.S., reported its monetary and working effects for the fourth quarter and entire yr ended Dec. 31, 2024. All monetary data offered on this unlock is in U.S. usually authorized accounting ideas (GAAP), unaudited, and in 1000’s of U.S. bucks until another way famous.

Fourth Quarter & Complete 12 months 2024 Monetary Highlights (in $ 1000’s, excl. margin pieces):

| [1] Denotes a non-GAAP measure. See “Non-GAAP Monetary Measures” on this press unlock for more info in regards to the Corporate’s use of non-GAAP monetary measures, in addition to Desk 4 for reconciliation, the place appropriate. |

| [2] Each Adj. Gross Benefit and Adj. EBITDA excludes $101k in This autumn 2023, $5.6 million for FY 2024 and $13.9 million in FY 2023; see the Corporate’s Annual Record on Shape 10-Ok for the duration ended December 31, 2024, for added disclosure. |

“As we persisted our corporate’s transformation during 2024, we carried out structural adjustments to the trade and done on key tasks to optimize our retail and cultivation belongings, divest non-strategic belongings, root out provide chain inefficiencies, and capitalize on adult-use adoption in Ohio,” The Cannabist Co. CEO David Hart mentioned. “Using a complete option to steadiness sheet control, on February 27, we introduced an settlement to increase the maturities on our senior secured debt till December 2028, with choices to increase via 2029. With lately 70% enhance from our noteholders, we’re assured that this procedure will likely be finished. This transaction supplies runway for us to concentrate on the ongoing optimization of our trade, as we entire divestitures, proceed to scale back working and overhead prices, refine our stock collection, and enhance the operational and fiscal efficiency of the corporate.

“Our mandate in 2025 is to proceed to simplify our trade, care for liquidity, enhance margins, and pressure money go with the flow era, placing us able to prevail. We’ve got significant catalysts in 2025, together with the transition to grownup use in Delaware and the addition of retail places in most sensible markets corresponding to Virginia and Ohio.”

Best 5 Markets by way of Income in This autumn[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

Best 5 Markets by way of Adjusted EBITDA in This autumn[3]: Maryland, New Jersey, New York, Ohio, Virginia

| [3] Markets are indexed alphabetically |

Monetary Highlights for Fourth Quarter and Complete 12 months 2024

- Fourth quarter income of $96.1 million, a lower of 16% from the 3rd quarter, basically on account of the sale of Jap Virginia and Arizona companies in August, in addition to 14 retail outlets in Florida all over This autumn.

- Gross margin within the fourth quarter used to be 35%, down sequentially, however up 120 foundation issues (bps) in comparison to This autumn 2023. For the overall yr 2024, adjusted gross margin remained flat at 38%.

- Adjusted EBITDA in This autumn of $7 million, as when put next with $14.8 million in Q3; sequential contraction used to be in large part pushed by way of the sale of belongings in Virginia and Arizona, which closed all over Q3, in addition to pricing power in numerous key markets.

- For the 12 markets last following the divestiture of Florida and Washington, D.C., gross margin for FY 2024 larger greater than 200 bps yr over yr, and altered EBITDA margin for the overall yr used to be necessarily flat in comparison to 2023 for the ones 12 markets.

- This autumn effects had been impacted by way of a $3.1 million provision for credit score losses and a $2.1 million intangible impairment.

- On Nov. 7, the corporate closed at the sale of all 14 Cannabist dispensaries and two cultivation amenities in Florida for attention of $5 million; transactions for the sale of the remainder Clinical Marijuana Remedy Middle (MMTC) license and one cultivation facility are pending finalization.

- Capital expenditures within the fourth quarter had been $1.7 million; the corporate continues to be expecting capital expenditures to reasonable $2 million to $3 million in keeping with quarter once more in 2025.

- In This autumn 2024, the corporate accomplished a favorable working money go with the flow of $4.3 million.

- The corporate ended the fourth quarter with $33.6 million in money, up from $31.5 million in money on the finish of Q3.

- Via a number of rounds of company restructuring all over 2024, the corporate accomplished $23 million in annualized price financial savings, because of changes to align with a simplified footprint.

- Next to the quarter shut, the corporate introduced an settlement with noteholders to increase the maturities of senior secured notes to December 2028, with choices to increase via 2029.

Operational Highlights for Fourth Quarter and Complete 12 months 2024

- For FY 2024, wholesale income larger 11% over 2023; wholesale accounted for about 15% of overall income in 2024, in comparison to 12% of overall income in 2023 and 14% in 2022.

- Wholesale income diminished 20% sequentially in This autumn, impacted partially by way of asset gross sales in Jap Virginia and Arizona; wholesale represented 16% of overall income in This autumn.

- New York demonstrated the biggest building up in adjusted EBITDA quarter over quarter because the wholesale marketplace stepped forward; New York used to be a Best 5 marketplace in gross margin and altered EBITDA in This autumn.

- On account of the sale of 14 retail places in Florida, the closure of 1 location in Boston, the sale of 1 location in California, the re-opening of 1 location in Colorado, and one new opening in New Jersey all over This autumn, the quarter-end lively retail rely used to be 59, in comparison to 73 lively retail places on the finish of Q3 and 86 at year-end 2023.

- In February 2025, the corporate closed 3 underperforming places in Colorado, bringing the whole lively retail rely to 56 at this time.

- The corporate has further retail places in construction, together with one in Virginia and 3 in Ohio.

Non-GAAP Monetary Measures

On this press unlock, the corporate refers to positive non-GAAP monetary measures, together with Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Benefit and Adjusted Gross Margin. The corporate considers positive non-GAAP measures to be significant signs of the efficiency of its trade. Those measures aren’t identified measures underneath GAAP, wouldn’t have a standardized which means prescribed by way of GAAP and might not be similar to (and could also be calculated otherwise by way of) different corporations that provide equivalent measures. Accordingly, those measures will have to no longer be regarded as in isolation from nor as an alternative choice to our monetary data reported underneath GAAP. Those non-GAAP measures are used to offer traders with supplemental measures of our working efficiency and thus spotlight tendencies in our trade that would possibly not another way be obvious when depending only on GAAP measures. Those supplemental non-GAAP monetary measures will have to no longer be regarded as awesome to, as an alternative choice to, or as a substitute for, and will have to be regarded as along side, the GAAP monetary measures offered. We additionally acknowledge that securities analysts, traders and different events incessantly use non-GAAP measures within the analysis of businesses inside our trade.

With appreciate to non-GAAP monetary measures, the corporate defines EBITDA as web source of revenue (loss) ahead of (i) depreciation and amortization; (ii) source of revenue taxes; and (iii) pastime expense and debt amortization. Adjusted EBITDA is outlined as EBITDA ahead of (i) share-based reimbursement expense; (ii) goodwill and intangible impairment, (iii) changes for acquisition and different non-core prices; (iv) achieve on remeasurement of contingent attention, web, (v) honest worth adjustments on spinoff liabilities; and (vi) honest worth mark-up for got stock. Adjusted EBITDA Margin is outlined as Adjusted EBITDA divided by way of Income. Adjusted Gross Benefit is outlined as gross benefit ahead of the honest mark-up for got stock. Adjusted Gross Margin is outlined as gross margin ahead of the honest mark-up for got stock.

The corporate perspectives those non-GAAP monetary measures as a way to facilitate control’s monetary and operational decision-making, together with analysis of the corporate’s ancient working effects and comparability to competition’ working effects. Those non-GAAP monetary measures mirror an extra method of viewing sides of the corporate’s operations that, when seen with GAAP effects and the reconciliations to the corresponding GAAP monetary measure, would possibly supply a extra entire working out of things and tendencies affecting the corporate’s trade. The resolution of the quantities which are excluded from those non-GAAP monetary measures is an issue of control judgment and depends on, amongst different components, the character of the underlying expense or source of revenue quantities. As a result of non-GAAP monetary measures exclude the impact of things that may building up or lower the corporate’s reported result of operations, control strongly encourages traders to check the corporate’s consolidated monetary statements and publicly filed experiences of their entirety.

Reconciliations of non-GAAP monetary measures to their nearest similar GAAP measures are integrated on this press unlock and an additional dialogue of a few of these pieces is contained in our annual document on Shape 10-Ok.